Topic

Kumba fast-tracking solar, customising green hydrogen, sees good lump premium prospects

By: Martin Creamer 22nd February 2022 South Africa’s major iron-ore producer and marketer Kumba Iron Ore is fast-tracking solar power permitting and looking to wind energy, it is... →

Cash-flush Kumba Iron Ore reports record earnings in exceptional year of delivery

By: Martin Creamer 22nd February 2022 Iron-ore mining and marketing company Kumba Iron Ore delivered record earnings of R64.6-billion in 2021, when it accumulated 47%-higher... →

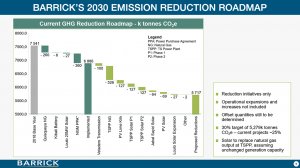

Absolutely clear we’ll reduce Scope 1, 2 emissions by 30% by 2030 – Barrick

By: Martin Creamer 17th February 2022 Gold and copper mining company Barrick has a detailed emission reduction roadmap in place that allows it to be unequivocal about the extent to... →

Red tape delaying R90bn investment in ready-to-go projects – Minerals Council

By: Martin Creamer 14th February 2022 Red tape is delaying investment worth R90-billion in ready-to-go mining-related projects, at a time when the South African economy is in desperate... →

The Minerals Council South Africa welcomes the 2022 SoNA address and its commitments to stimulate the economy

11th February 2022 President Cyril Ramaphosa’s State of the Nation Address 2022 outlined measures to address the key challenges to the economy that the Minerals... →

NUM PWV Region concludes a three year wage agreement with Vergenoeg Mining

25th January 2022 The National Union of Mineworkers (NUM) in PWV signed a 3-year wage agreement with Vergenoeg Mining Company for a period of 1 January 2022 to 31... →

Minerals Council backs State capture commission’s recommendations

By: Martin Creamer 6th January 2022 Minerals Council South Africa on Thursday endorsed the recommendations of the first report of the Commission of Inquiry into State Capture. The... →

Energy transitioning countries stand to attract major FDI investment, webinar hears

By: Martin Creamer 15th December 2021 Countries that choose to transition into clean energy stand to attract major foreign direct investment (FDI) flows, as do companies that follow a... →