Topic

Tax relief options can help South African expats protect their foreign-earned income

18th November 2024 Meet Peter X. He is living the good life abroad, but only because he works hard for his money. With tax filing season upon him, he will do well to... →

Ramaphosa appoints Presidential Economic Advisory Council for new administration

15th November 2024 President Cyril Ramaphosa has appointed a new Presidential Economic Advisory Council (PEAC) as part of the seventh administration’s ambition for... →

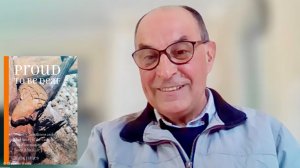

The Human Bridge: Racial Healing in South Africa – Ian Fuhr with Nina De Klerk

14th November 2024 The greatest gift we can give to our children, and the future South Africa, is our own healing. South Africa may have moved beyond apartheid, but... →

Sars’ Ongoing Efforts in Debt Collection and Dispute Resolution

14th November 2024 The South African Revenue Service (Sars) continues to face challenges in collecting receivables while addressing ongoing disputes with taxpayers.... →

Crypto Tax Compliance: New Frontiers in Enforcement and Reporting for Taxpayers!

13th November 2024 The 2023/24 tax year marked a shift in Sars’s approach, with the revenue collector announcing in early October than it will be including crypto... →

Sars voluntary disclosure programme drives R3.3-billion in tax collections

12th November 2024 The South African Revenue Service (Sars) Voluntary Disclosure Programme (VDP) is a cornerstone of Sars’ approach to encouraging taxpayer compliance... →

Sars Turns up the Heat: Why Employers Must Get PAYE Right

8th November 2024 The South African Revenue Service (SARS) has signalled a stronger focus on Pay-As-You-Earn (PAYE) compliance, as highlighted in its 2023/24 Annual... →

R342.9-billion in VAT Refunds: Are South African Businesses Waiting Too Long For What They Are Owed?

7th November 2024 In the 2023/24 financial year, South Africa’s VAT refunds hit an unprecedented R342.9-billion, reflecting a robust 7.5% increase year-on-year, as... →