JOHANNESBURG (miningweekly.com) – Toronto- and New York-listed Platinum Group Metals Limited is in discussion with several South African smelter operators, including Impala Platinum (Implats), with a view to negotiating formal metal concentrate offtake arrangements for the Waterberg project, which is planned as a mechanised, shallow, decline-accessed platinum, palladium, rhodium and gold mine, with copper and nickel by-products.

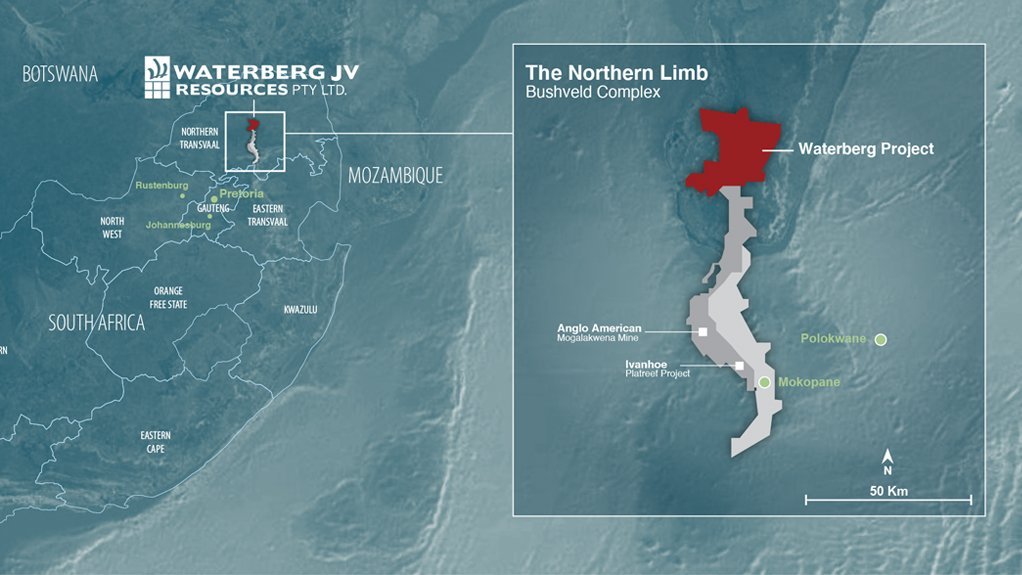

Implats is a 14.86% shareholder in the project, which is located on the northern limb of the Bushveld Igneous Complex, about 85 km north of Mokopane, in Limpopo.

The objective is to advance the Waterberg project to a development and construction decision including the arrangement of construction financing.

While this is happening, the Canada-based company is targeting the use of platinum and palladium in lithium battery technologies through the Lion Battery Technologies initiative, which is being undertaken in collaboration with Anglo American Platinum and Florida International University.

The investment in Lion creates a potential vertical integration with a broader industrial market development strategy to bring new palladium and platinum-using technologies to market, and technical results from research potentially having application to most lithium-ion and lithium-sulphur battery chemistries.

In addition to discussing local smelting, Platinum Group Metals last year entered into a memorandum of understanding with Ajlan and Saudi Arabia’s Investment Ministry for the establishment of a platinum group metals (PGM) smelter and base metal refinery in Saudi Arabia.

A key requirement would be to secure a long-term permit for the export of unrefined precious metals in concentrate from South Africa.

The latest independent definitive feasibility study (DFS) released in September was more emphatic than ever on the economic viability and wealth creation potential of the R18.8-billion Waterberg project, which has a longer 54-year life-of-mine (LoM) outlook, up from the earlier 45-year LoM projection of average production in concentrate of 353 208 four element (4E) a year and peak annual production of 432 950 4E oz.

Under the latest financial model, construction is deemed to begin in December 2025, with first production in September 2029. Ramp-up to steady state would then be in May 2032, with mining ongoing until 2081.

Two thousand jobs would be created during construction and 1 425 permanent jobs as steady state mining is achieved.

The DFS points to lower cost and higher free cash. The proven and probable mineral reserves are one-fifth higher at 23.41-million 4E ounces, plus 0.08% copper and 0.17% nickel.

Net present value is R11.5-billion, cash cost an average $658/4E oz, all-in sustaining cost $761/4E oz, and free after-tax cashflow R130.59-billion.

Platinum Group Metals discovered this section of the Bushveld Complex in November 2011, funded by Japan Oil, Gas and Metals National Corporation, or Jogmec. The Department of Minerals Resources and Energy granted the mining right in 2021.

Recently received by Platinum Group Metals is its fourth annual environmental, social and governance (ESG) disclosure report from UK company Digbee, which has developed an Equator Principles-aligned framework for improving ESG performance.

Amid its strategic investments, Platinum Group Metals incurred a net loss of $1.84-million in the three months ended November 30, with expenditure since inception totalling $89.70-million.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here