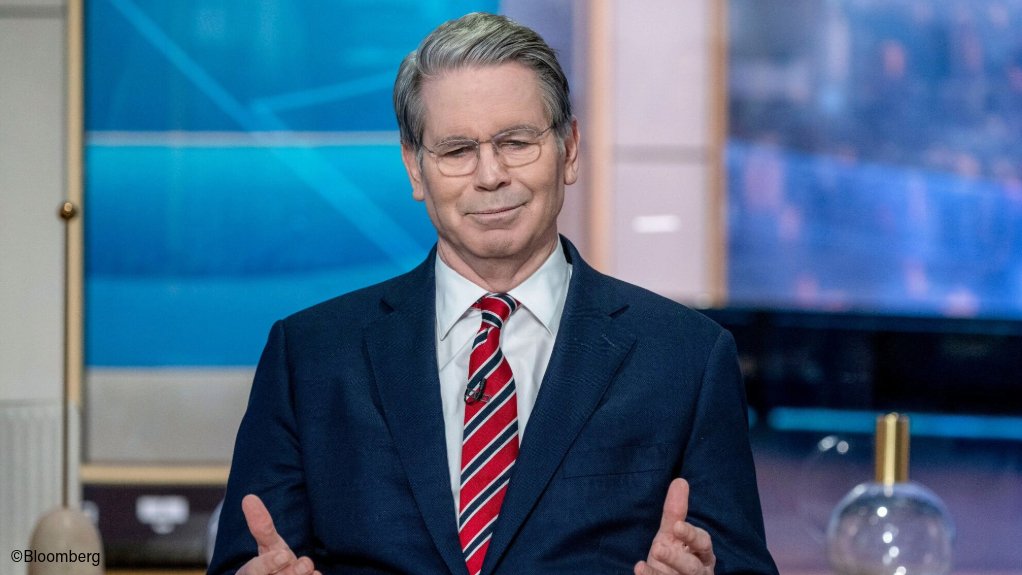

US Treasury Secretary Scott Bessent on Thursday laid out the Trump administration's ambitions to reshape international trade relations with tariffs, roll back financial regulations on American banks, and use sanctions to collapse Iran's economy.

President Donald Trump has begun an "aggressive campaign to rebalance the international economic system," Bessent told the Economic Club of New York. "The American Dream is rooted in the concept that any citizen can achieve prosperity, upward mobility, and economic security. For too long, the designers of multilateral trade deals have lost sight of this."

In regard to Iran, he said the new administration would exert a campaign of maximum pressure of sanctions to choke off its oil exports and put pressure on its currency. "Making Iran broke again will mark the beginning of our updated sanctions policy," Bessent said.

Over the past six weeks, Trump has undertaken a massive shift in priorities and direction on both the global and domestic stage. His international trade policy on Thursday continued to evolve after he gave Canada and Mexico a one-month reprieve on 25% tariffs imposed earlier this week on any goods that fall under the United States-Mexico-Canada Agreement on trade.

Interviewed on stage by former Trump economic adviser Larry Kudlow in front of an audience that included Blackstone CEO Stephen Schwarzman and GAMCO Investors CEO Mario Gabelli, Bessent - a hedge fund billionaire himself - warned that trading partners who retaliate will face even higher duties on their US exports, calling Canadian Prime Minister Justin Trudeau a "numbskull" for doing just that.

"As President Trump has said many times, tariff is his favourite word. I would say that reciprocal is probably his second favourite word," Bessent said. "If you want to be a numbskull like Justin Trudeau and say, 'oh, we're going to do this,' then ... tariffs are going to go up. But if you want to sit back, have a discussion with the Commerce Department, USTR (US Trade Representative) - they all have my phone number too - I am happy to have a discussion with our foreign counterpart."

The US has promised reciprocal tariffs starting April 2. Bessent said tariffs would deliver benefits on a number of fronts, including to lower-income families who stand to be hardest hit by the higher prices the levies will bring.

"One, it is a good source of revenues. Two, it protects our important industries and their employees. And three, (Trump has) added a third leg to the stool and he uses it for negotiating," Bessent said. Far from being a regressive tax, he said, the "substantial" revenue from tariffs will help pay for tax cuts for earners in the bottom 50%, such as no taxes on tips.

BANK REGULATIONS

Bessent also said the Treasury would lead a "comprehensive and assertive effort" to enable banks to boost the US economy. A top priority in that effort will be a "fundamental refocusing" of how the nation's regulators supervise its banks.

The banking industry has long complained current bank supervision is opaque, subjective, and needlessly restrictive, and Bessent echoed those concerns, saying bank supervisors should be focused on "material financial risk rather than box-checking."

Specifically, Bessent said he planned to utilize multi-agency bodies like the Financial Stability Oversight Council to steer a unified regulatory approach, and noted a recent Trump executive order gave the administration direct oversight over independent agency rule-writing.

Notably, Bessent appeared to rule out consolidation of existing bank regulators, which had been rumoured to be under consideration by the Trump administration, when discussing how they should operate in unison.

"To be clear, this does not mean consolidation of agencies, but coordination via Treasury, such that our regulators work in parallel with each other and industry," he said.

Bessent singled out the supplementary leverage ratio (SLR), which requires banks to reserve capital regardless of how much risk is on their books, as a matter requiring review. He stopped short of endorsing any particular fix, but noted the SLR should serve as a backstop, and not bind bank activities by forcing them to hold capital against safe assets like US Treasury bonds or central bank reserves.

EMAIL THIS ARTICLE SAVE THIS ARTICLE FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here