UN Trade & Development, better known as Unctad, has reported, in its latest 'Global Investment Trends Monitor', that global foreign direct investment (FDI) fell by 3% during the first half of this year, year-on-year. This continued what was now a two-year “slump” (Unctad’s word) in FDI, caused by trade stresses, high interest rates and international political uncertainties.

“The drop was driven by developed economies, where cross-border mergers and acquisitions (M&As) – which normally make up a large share of their FDI – fell 18% to $173-billion,” pointed out Unctad. “Developing economies fared better overall, with flows remaining flat. But trends diverged by region. Inflows rose 12% in Latin America and the Caribbean and 7% in developing countries in Asia but fell 42% in Africa.”

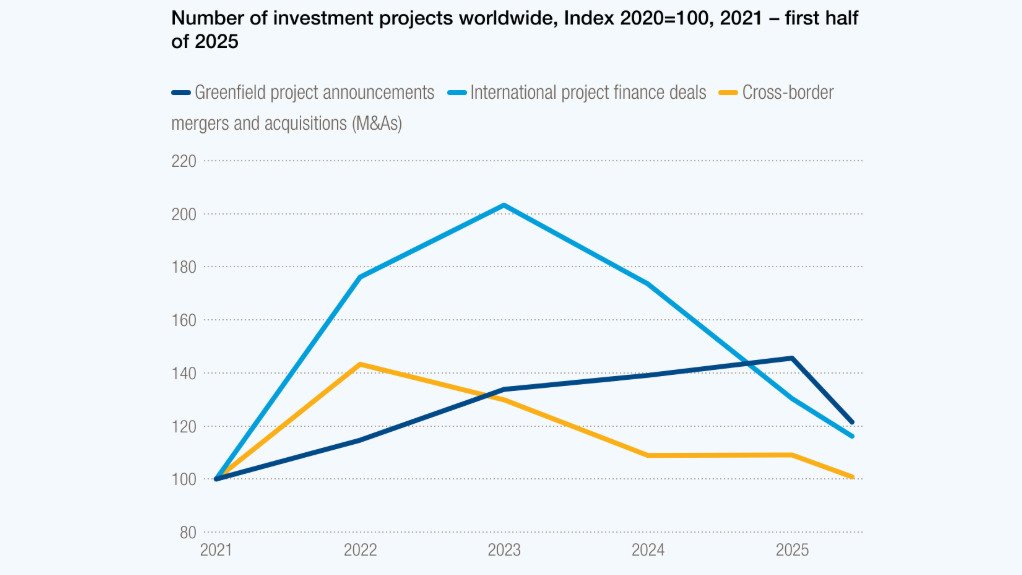

While the number of greenfield projects increased worldwide by 7%, global international project finance fell by 8% and cross-border M&As dropped by 23%. With regard to developed economies, FDI fell by 7%, and, although greenfield projects jumped by 48%, international project finance plummeted by 32% and cross-border M&As by 18%. Concerning developing economies, they saw a zero per cent change in FDI, although a 37% drop in greenfield projects, while international project finance increased by 21%. There was no data on developing economy cross-border M&As.

Regarding developed regions, Europe saw a 25% fall in FDI, a 28% increase in greenfield projects, a 35% drop in international project finance and a 1% decline in cross-border M&As. North America experienced a 5% increase in FDI, a 79% jump in greenfield projects, a 36% fall in international project finance and a 23% drop in cross-border M&As. The category “other developed economies” recorded a 7% decline in FDI, a 23% increase in greenfield projects, a 12% reduction in international project finance and a 52% collapse in cross-border M&As.

Concerning developing regions, Africa (as noted above) saw a fall of -42% in FDI, and also experienced a -58% collapse in greenfield projects, but had a slight (1%) rise in international project finance; there was no data on cross-border M&As. Latin America and the Caribbean had a 12% increase in FDI, although greenfield projects were down 15%; international project finance rose 23% and cross-border M&As rocketed by 254%. Developing Asia saw FDI rise by 7%, but greenfield projects dropped by 20%; international project finance was up 29% but cross-border M&As collapsed by 67%.

“High borrowing costs and economic uncertainty continue to squeeze investment in industry and infrastructure in the first half of 2025,” noted Unctad. “Announcements of greenfield projects – when firms build new operations abroad – fell 17% in number, driven by a 29% decline in supply-chain-intensive manufacturing such as textiles, electronics and automotives, amid tariff uncertainty. International project finance – critical for infrastructure development – also declined, with deal numbers down 11% and value 8%.”

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here