JOHANNESBURG (miningweekly.com) – The good gold price is providing gold mining companies with much more confidence to execute capital programmes, and a sentiment doing the rounds is that South Africa should, in every respect, make the most of it while it lasts.

Many brownfield gold-mine extensions will now likely make economic sense and the assumption is that at least portions of better cashflows will be deployed to fund further on-strike probes as well as the maximum recovery of gold from on-surface tailings.

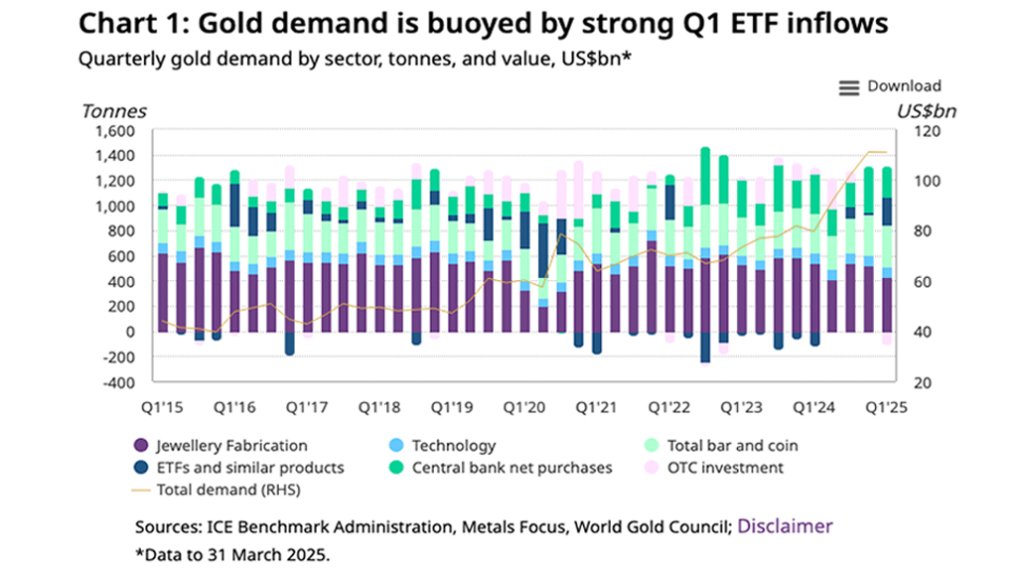

The first quarter of this year saw gold investment demand soar 170% to 552 t and overall gold demand hit the 1 206 t mark, World Gold Council stated in its latest report.

A poll of 29 analysts and traders returned a median gold price forecast of $3 065/oz for this year, up from the $2 756 predicted three months ago. The poll price estimated for 2026 rose to $3 000 and some big guns even dared to predict $4 000/oz by the second quarter of next year and close to $5 000/oz in 2028.

The prevalent South African outlook is that the gold price will remain at elevated levels for some time, and that South Africa’s public and private sectors should work together now to enable mining in general and gold mining in particular to perform at full economic and socioeconomic potential.

DRDGOLD CFO Riaan Davel is one of many who are expressing keenness to see South Africa take up the opportunities that the good gold price is continuing to present. (Also watch attached Creamer Media video.)

Davel highlighted the additional confidence that the good gold price is instilling during an interview with Mining Weekly on the sidelines of 130th anniversary of DRDGOLD’s listing on the Johannesburg Stock Exchange (JSE).

“It’s giving us much more confidence to execute our capital programme. Over the next couple of years, we'll be building a massive facility on the Far West Rand, the RTSF (a regional tailings storage facility), with a capacity of 800-million tons, while also extending the Ergo tailings facility on the East Rand, so it has really boosted our confidence to go and execute all that to enable us to continue mining for a very long time.

“Even while we’re constructing, we’re generating cash, and what a buoyant current gold price environment to be part of. Hopefully we can make the most of it,” Davel enthused, while also expressing great elation about DRDGOLD’s own remarkable journey all the way from 25 April 1895 – as well as that of the JSE.

“It's really special" – and even more special is that DRDGOLD, with a market capitalisation of R27-billion, is still going flat out on a JSE that has a market capitalisation two-and-a-half times the GDP of South Africa.

Mining Weekly: What can this gold price now open up for South Africa as a whole?

Davel: It definitely creates many opportunities for gold mining firstly, but also for mining as a whole. We’re in a different world globally, with many different factors than a year ago, so it’s time for us to again work together, to look at opportunities, and I really hope that government sees that we want to make a difference with them. We want to create jobs. We want to better communities’ lives. That, for me, always should fit right into government objectives. The opportunities are there. It's for us to pull together. Obviously, there’ll be price corrections along the way, but I believe the gold environment is buoyant for the medium term and hopefully even for the long term, as well.

EXTENDING OPERATIONAL LIFE

Roodepoort-heaquartered DRDGOLD, which is now executing a R10-billion capital investment programme, has just come off a R3-billion outlay in a large solar energy project on Gauteng’s East Rand, where its flagship Ergo gold-from-tailings projects is entering a new growth phase.

“That's exciting for Ergo from a cost point of view, and again to secure longer operational life. Then, on the Far West Rand, we don’t own as many tons as the facility that we’re building can cope with, but we know the opportunities are there in that area.

“Our vision is to ultimately mine all the gold-bearing material that's still available on the East Rand and the West Rand. Ultimately that is our purpose because that would have reversed the environmental legacy of mining – and then the very exciting part.

“I believe that we show that our model can be replicated anywhere in the world, where large-scale mining has taken place, where you can say, maybe don't wait until the end for environmental reversal or restoration.

“Start on day one of mining, and that planning can happen. We've shown that we can take infrastructure that's old, up that and then at least settle environmental liabilities towards the end of the mine. So, I really believe our model can be replicated, and we must look for opportunities elsewhere in the world as well."

Game returning to where biodiversity has been restored on the East Rand is attracting attention.

Environmental grassing to reduce dust has been done over many years but that has been elevated to biodiversity coming close to being fully restored.

One site to which game is returning shows few signs if any of ever storing mine waste.

“Natural vegetation has returned, and that's really positive,” Davel commented.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here