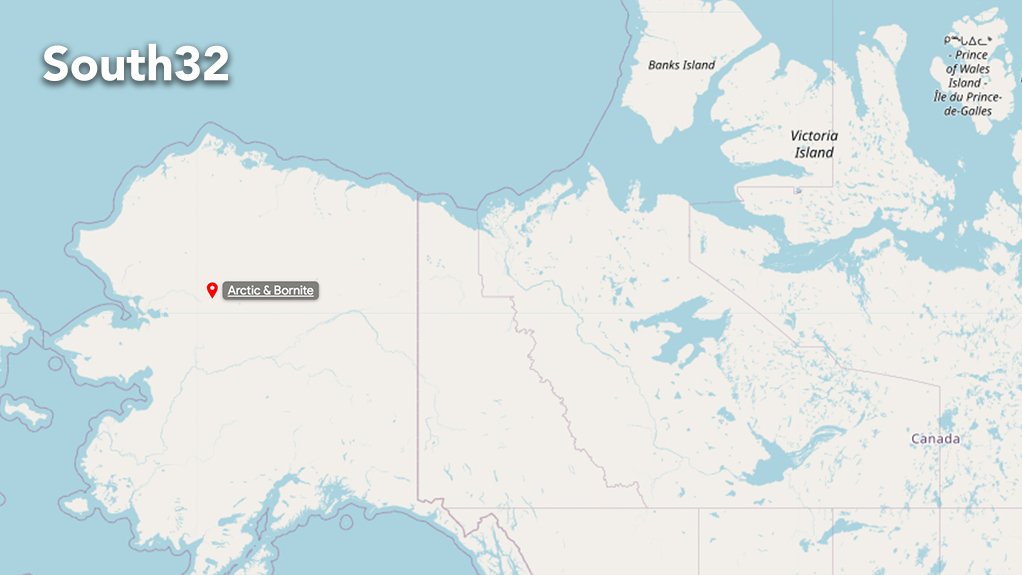

JOHANNESBURG (miningweekly.com) – Johannesburg Stock Exchange-listed South32 is targeting the copper-dominant Arctic project in the Ambler mining district of north-western Alaska with its Canada-based 50:50 joint venture (JV) exploration and development partner Trilogy Metals.

"During the quarter, our Ambler Metals joint venture approved a $35-million work programme to advance the high-grade Arctic polymetallic deposit and test exploration targets within this underexplored, regional land package in Alaska," South32 CEO Graham Kerr disclosed in the diversified mining company’s latest quarterly report released on Thursday, January 22.

Mining Weekly can report that Ambler Metals, the operating company for the Upper Kobuk Mineral Projects, has signed off on a 2026 programme that prioritises preparation of mine permit submissions for the Arctic project, while advancing engineering, environmental and technical work required to support a future final investment decision.

The JV is targeting 2026 mine permit submissions and assessing the potential to leverage US federal expedited permitting frameworks, including FAST-41, which is a process of reducing environmental review timelines.

Alongside the permitting push, Ambler Metals plans to continue technical and organisational derisking across the Upper Kobuk Mineral Projects, with this year’s exploration activities focusing primarily on the Arctic project and geotechnical and drilling programmes intended to support mine design, infrastructure placement and production planning.

Also featuring in the 2026 programme is the Bornite project, with the JV is planning to reopen the Bornite camp during the summer field season. Work will include geotechnical and exploration drilling, as well as camp maintenance and capital improvements to enable multi-year use and future exploration campaigns.

Ambler Metals will also re-establish an independent management team during 2026 to oversee the next phase of project advancement. This team will be tasked with progressing permitting for the Arctic project, executing critical drill programmes, advancing technical studies and strengthening community engagement, workforce development and local participation.

SOUTH AFRICAN ALUMINIUM

In South Africa, South32’s half-year aluminium production increased by 2% amid the Hillside Aluminium operation in Richards Bay, KwaZulu-Natal, continuing to test its maximum technical capacity.

Studies being undertaken on the future power source for South32’s Hillside Aluminium beyond 2031 are taking place amid awareness of the different energy levers that can potentially be pulled for Hillside, the southern hemisphere’s largest aluminium smelter.

The power agreement, which extends to 2031, is providing time to study power options for Hillside, which draws on 1 140 MW virtually every minute of the day, every day of the week, every week of the year.

The competitive smelter contributes nearly R10-billion to South Africa’s GDP and public–private effort could ensure that the aluminium produced can benefit from the green price premium being paid for carbon-light aluminium.

SOUTH AFRICA MANGANESE

Manganese production increased by 58% in the December 2025 half-year, when Australia Manganese returned to normalised production rates and South Africa Manganese completed planned maintenance.

South Africa Manganese is located in the manganese-rich Kalahari basin that hosts 80% of the world's manganese and is made up of the opencast Mamatwan mine, which began operating more than half a century ago, and the underground Wessels mine, which followed a few years later.

The two mines are part of the Hotazel Manganese Mines consortium, in which South32 holds 44.4%. The remaining interest is held by Anglo America plc and broad-based black economic empowerment entities amid manganese being a metal with important industrial uses, particularly in steel.

PRODUCTION AS GUIDED

First-half production and operating unit costs are tracking in line with guidance across most operations.

“Our consistent operating performance, combined with strengthening market conditions, enabled the group to maintain a strong financial position while investing in our high-returning growth options and delivering returns to shareholders.

"Completing the divestment of Cerro Matoso during the quarter further simplified our business, consistent with our strategy to focus our portfolio on high-quality operations and growth options in base metals.

"We also progressed construction of Hermosa’s large-scale, long-life, Taylor zinc/lead/silver project, and completed the exploration decline for the Clark battery-grade manganese deposit.

“Sierra Gorda delivered strong copper volumes and cash returns, and we are pursuing further copper growth through our pipeline of development options and exploration prospects,” Kerr stated in the release to Mining Weekly.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here