South African central bank Governor Lesetja Kganyago warned that US protectionist policies may derail future interest-rate cuts by central banks if they turn out to be inflationary, though there are currently too many “moving parts” to be certain about the outlook.

Donald Trump, who was sworn in as US president on Monday, said he plans to enact previously threatened tariffs of as much as 25% on Mexico and Canada by February 1.

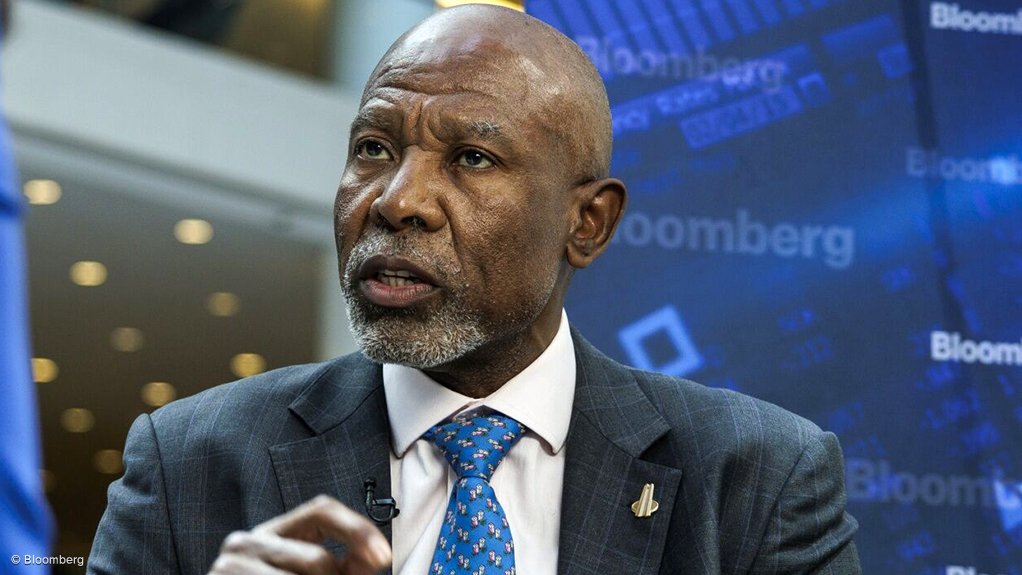

“To the extent that the measures taken are inflationary, it could slow down the disinflation process that the central banks had so steadfastly worked on since the great inflation of 2022,” Kganyago said in an interview with Bloomberg TV at the World Economic Forum in Davos on Tuesday. “And the risk is then that the accommodation, or should I say, the reduction in the restrictiveness of monetary policy that we had seen over the past year, could then be brought to an abrupt halt.”

Central banks around the world — including those in the US, the European Union and South Africa — began reducing rates last year as inflation started easing.

The South African Reserve Bank cut its benchmark interest rate by 25 basis points for a second straight meeting in November to 7.75% and is expected to keep its easing cycle brief and shallow, although another quarter-point reduction is forecast when policymakers meet on January 30.

EMAIL THIS ARTICLE SAVE THIS ARTICLE FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here