South Africa's economic outlook is better this year than last, but the inflation picture is more muddied as risks abound, its central bank governor said on Tuesday.

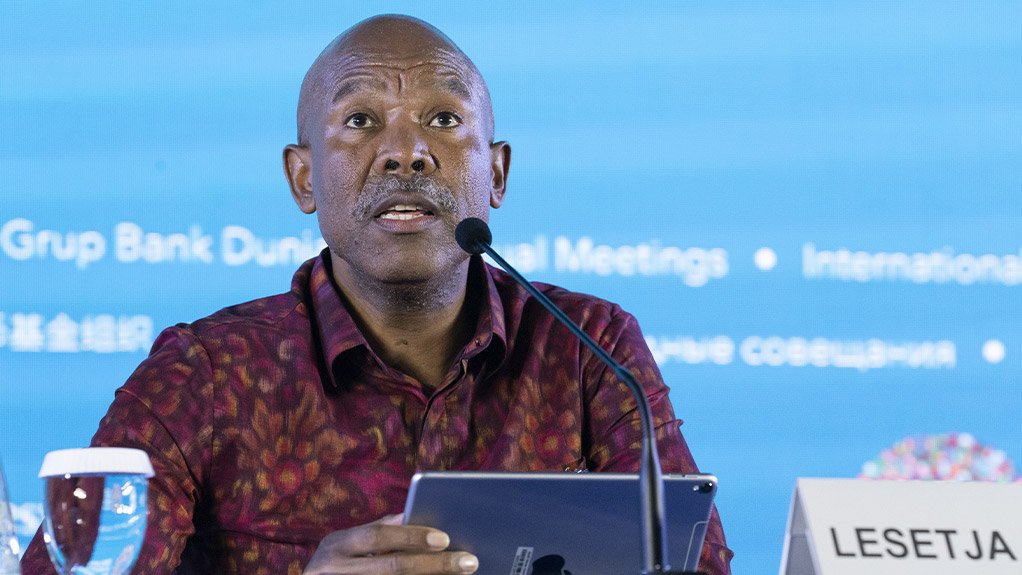

South African Reserve Bank (SARB) Governor Lesetja Kganyago told Reuters in an interview at the World Economic Forum's annual meeting in Davos, Switzerland, that growth in Africa's most industrialised economy could be close to 2% in 2025, versus the 1.1% growth projected for 2024.

"Depending on who is forecasting, growth varies between 1.6% and 2% (this year). We think ... it would be closer to 2% than closer to 1.6%," he told the Reuters Global Markets Forum.

Kganyago cited the formation of a broad coalition government last year as one of the key enablers of faster growth.

"The structural reform agenda has gained momentum, and it has been given impetus by this Government of National Unity with a very clear focus on taking South Africa's economic trajectory to the next level," he said.

The coalition that emerged after the long-ruling African National Congress lost its parliamentary majority includes the business-friendly Democratic Alliance and a host of other smaller parties from across the political spectrum.

Investors are optimistic that reforms in key sectors such as electricity, freight rail and the visa system will accelerate and lift the annual growth rate beyond the meagre 1% it has averaged over the past decade.

Kganyago warned that South Africa's inflation outlook could be muddied by factors including protectionist policies with the return of US President Donald Trump to the White House.

With other risks including the rand exchange rate, the global oil price and local food prices, there are "too many moving parts" to have a clear view on price pressures, he said.

Annual consumer inflation was at 2.9% in November, below the SARB's target range of 3%-6%, although it is expected to rise in December and this year average about 4.5%, the midpoint of the range which the bank aims for.

The SARB cut interest rates at its last two meetings of 2024, and many analysts expect a further cut at its first announcement of the year next Thursday.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here