JOHANNESBURG (miningweekly.com) – Last week renewable energy company Seriti Green received a budget quote from Eskom that it had applied for as long ago as February 2021 – that's the delay in obtaining collaboration from the State power utility, which held up a R5-billion investment. Seriti Green now has five times more to invest but is being delayed once again, despite South Africa needing all the investment it can get to lower unemployment.

Through its Seriti Green Hub platform, which is a dedicated skills and employment portal, the company has registered more than 10 000 job seekers. Seriti is particularly focused on transitioning former mine staff into renewable energy roles, providing opportunities for individuals to transfer their skills into new industries.

As reported by Mining Weekly in December, Mpumalanga has been selected to host the Group of 20 (G20) energy session in September, which Seriti Green expects will propel the province onto the global stage, setting the standard for future power supply with international standards and protocols. G20 Ministers will convene in Mpumalanga from September 23 to 26 to discuss the energy mix, lower carbon-emitting technologies and other aspects of the Just Energy Transition referred to as JET.

It's creating jobs, training the next generation of renewable-energy professionals and ensuring that communities benefit directly from this transformation. But budget-quote delays are holding up what the company is ready to invest right now.

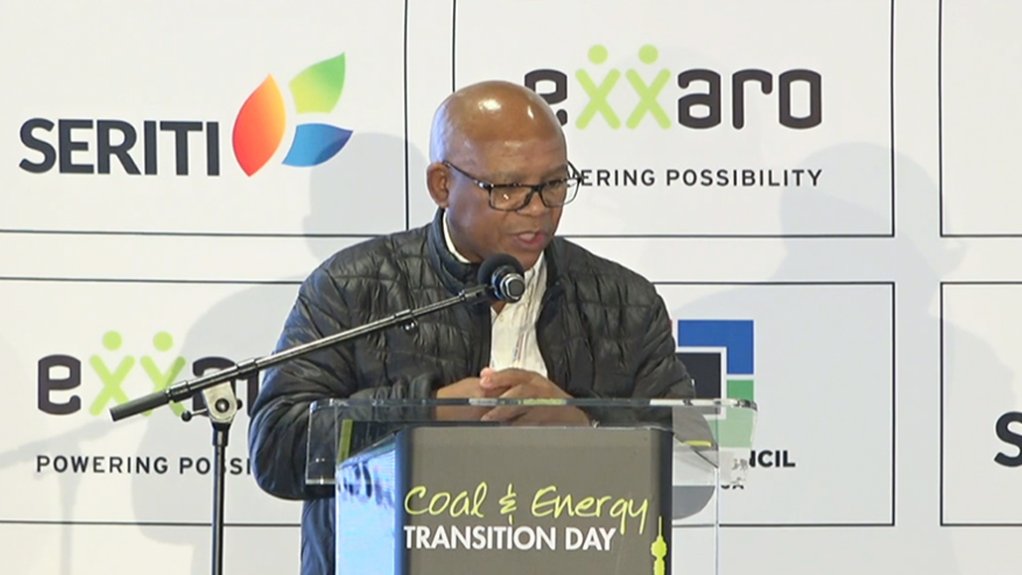

"We have R25-billion to deploy in Mpumalanga for wind farms, and we can't get budget quotes," Seriti Green CEO Peter Venn disclosed at this week’s Coal & Energy Transition Day event in Johannesburg.

Seriti Green is part of South Africa’s Seriti Resources energy company that is ramping up a new coal mine in Mpumalanga while erecting its fourth wind turbine nearby. Seriti Resources is headed by coal-mining entrepreneur CEO Mike Teke, who grew up in a township on Gauteng’s East Rand. Mining Weekly can report that the first job of the KwaThema-born Teke was as a R76-a-week labourer at Van Leer, in Springs, in 1984. Today Seriti Resources is the biggest supplier of coal to Eskom.

At this week’s Coal & Energy Transition Day, Teke's colleague Venn was responding to questions put to him by Accenture’s Partners In Performance partner Alastair Muller, who chaired a panel discussion in which Cennergi Holdings CFO Tebogo Movundlela, South African Wind Energy Association senior technical adviser Vincent Kok, Africa GreenCo business development adviser Ricardo Hansby, and South African Photo Voltaic Association grid access working group chairperson Zayd Vawda also took part.

During the discussion, Venn called for a complete repurposing of South Africa’s Renewable Energy Independent Power Producer Procurement Programme (REIPPPP), the government bidding process that aims to increase South Africa's renewable-energy capacity through private-sector investment, which involves multiple bid windows where independent power producers (IPPs) submit bids for renewable energy projects, and the government evaluates and awards contracts to successful bidders.

“The REIPPPP process needs to be repurposed to focus on transmission and battery storage, the things of the future, where we need government support and subsidies. What we need to get is grid allocation rules that work,” Venn said.

“The REIPPPP was a fantastic programme for the first three years – high prices, a market where no one knew anything. There were no skills, there was no finance. How communities react was unknown, and plans had to be made for all the trucks on the road.

“Since we’ve had the seven-year hiatus in projects, the REIPPPP is defunct. It's now for cheap solar. I don't know how projects make any IRR. Miners in the house, please laugh. You know you’re banking projects at 11% and 12% IRRs.

"If you're doing 50c solar, the risk is just so large. With all the community upheaval and all the other risk you take, to make 10% or 11% IRR is crazy,” Venn commented.

PAID ESKOM R21-MILLION, PUT UP R180-MILLION GUARANTEE

Regarding the long delays in receiving budget quotes from Eskom, Venn told the Coal & Energy Transition Day covered by Mining Weekly: “We received our budget quote that we applied for in February 2021 last week, and we paid Eskom a privilege of R21-million and then R180-million guarantee for that. So, we're all in for R200-million and it took four years – and that holds up a R5-billion investment.

He then elaborated on R25-billion that Seriti Green had in hand to help the economy of Mpumalanga yet had been unable to go ahead with its deployment.

Earlier in an interview with mining luminary Bernard Swanepoel, Teke outlined his group’s intention to generate as much energy as possible for the good of the South African economy and also for the continent of Africa.

Referring to the company’s activities in Mpumalanga, he told Swanepoel: “Today, as I speak to you, our fourth wind turbine is probably on its way up.”

Teke was speaking after Electricity and Energy Ministryspecial adviser Silas Zimu stated that quicker-to-rollout renewables are what will save South Africa as far as its commercial, residential and agricultural energy needs are concerned.

Despite this, Eskom is holding up the R25-billion Seriti Green is at-the-ready to deploy.

“Winning the REIPPPP doesn't help you get your grid allocation. Actually, the other way around. You win this and you don't get that,” he said of what awaits South Africa’s IPPs.

“The IPP Office should really focus on new tech, providing good rules, getting out of the way, and potentially bringing some of these programmes to new areas in the country where there is grid. You haven't had a wind farm allocated in three bid windows,” Venn pointed out.

RENEWABLES AND BASELOAD

While many assume that renewable energy is not a candidate for the provision of baseload power, some members of the panel questioned by Muller spoke of it being envisaged amid cheapening electricity storage advances.

These were among the baseload questions put by Muller:

Muller: What is the timeframe for renewable energy to provide 100% of baseload power?

Kok: There are three legs to that. Firstly, let’s look at the load factors per technology. If you look at Nersa’s REIPPPP performance report for 2024, this report had wind coming in at 37%, solar PV at 25% and CSP at 30%. Then you've got biomass and hydro. In isolation, those technologies cannot provide baseload. But once you start combining those and looking at the risk mitigation projects, BESS plus solar PV plus wind, a load factor of close to 70% is provided. Coal plants in South Africa operate with a 65% to 75% load factor, so it's possible and it's happening, but time needs to tell, because if you combine the technologies, you're increasing the energy tariff that comes with it. Applying economies of scale, and we've got a lot more risk mitigation to copy and paste across the country, the tariff would become lower, a lot more competitive, and we would be taken closer to baseload. But the third thing that I would echo is that the energy mix is still key. An association cannot stand in isolation, only advocating for its own technologies. We need to consider what the energy planners are telling us. So, what does the system operator want? What does diversification look like to ensure energy security? And then, thirdly, what does the demand profile look like for the country?

Muller: What baseload role can solar and wind play in sub-Saharan Africa?

Vawda: I agree with Vincent Kok that there's a future for baseload renewable energy. The intermittency question has always been plaguing the renewable energy industry from day one. We're not shy about it. We don't hide it. We just have to confront it. As associations, we're not saying that renewable energy has to take over. We’re saying that the word ‘mix’ needs to be in there. So, there needs to be some coal, some nuclear, some wind, some solar. But to get to the core point of the questions I ask is there going to be baseload renewables? I think there is going to be, one day. When the sun doesn't shine and the wind doesn't blow, there's no power going to be generated. We can't get away from that fact, but in South Africa, we're blessed. We have a lot of sunshine, a lot of wind, and sometimes the sun shines during the day, and generally our wind farms tend to perform well in the evenings. That alone is not going to solve the baseload problem. I think there's a future, especially when you're going to combine all those with battery technologies, which is coming. When we started the renewable-energy industry in earnest ten years ago, prices were very high. Everything was expensive, and they needed REIPPPP to kick start wind and solar in South Africa. Several REIPPPP rounds later, the private sector took off, and we have some of the cheapest energy from wind and solar in the world. We are actually at the same point - but getting there faster - with battery storage. The REIPPPP energy storage programme launched last year has kick-started energy storage in a big way in South Africa. Prices are coming down. I'm seeing a lot of hybrid plants starting. I think from next year we're going to start seeing a play for wind and solar, or solar and BESS take off some of the slack from the coal plants. It is coming. Elsewhere in Africa, where there isn't a backup grid, it is already being done. Tariffs are high, but it's only the beginning. As the price comes down, that baseload will become more affordable in more mature markets like South Africa as well.

Muller: How's grid capacity affecting the IPPs and what action needs to take place to unlock that capacity?

Vawda: It's a good question, and it's the most important question. If you ask anybody in renewables, what's your biggest problem, they're going to tell you that it’s grid access, grid access, grid access. There's just not enough grid. That’s a challenge to solve. A lot of people try and use that against renewables and say that there's no grid now, we can't have renewables. But, as associations, we say it's actually a good thing. It's a sign of maturity that we're starting to add more capacity onto the grid, and we're running up against the challenge where we need to add more infrastructure to back it up. Other countries in the world also got to the same point as we did, so we're catching up with the rest of the world as well. Grid capacity is a problem in South Africa, and as associations, we're trying to engage to help Eskom, to capacitate Eskom, for Eskom to upgrade their infrastructure, whether with substations, overhead lines, deep upgrades, it's going to come. We're quite positive because there's a lot of talk for the IPP Office and the DEE about launching private-sector participation in the grid infrastructure. Once that comes, the private sector will do its part, come to the party, and grid access will eventually become unlocked. Is it going to happen in the short term? No, I wish it would. But at the moment, it's something that the private sector is dealing with. Some of the things we as associations want to help solve, for example, are interim capacity allocation rules and grid access - make that easier and more streamlined. Derisk it so that lenders like it a little bit better, as well as make it more investor friendly for the private sector. There’s hope on the horizon. Towards the end of the year, we’re looking to see an RFP launched, hopefully, to get the same REIPPPP success story repeated in the transmission space as well.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here