JOHANNESBURG (miningweekly.com) – Many countries are still pursuing the development of platinum- and iridium-using green hydrogen infrastructure, including China where green hydrogen features in the latest Five-Year Plan to 2030.

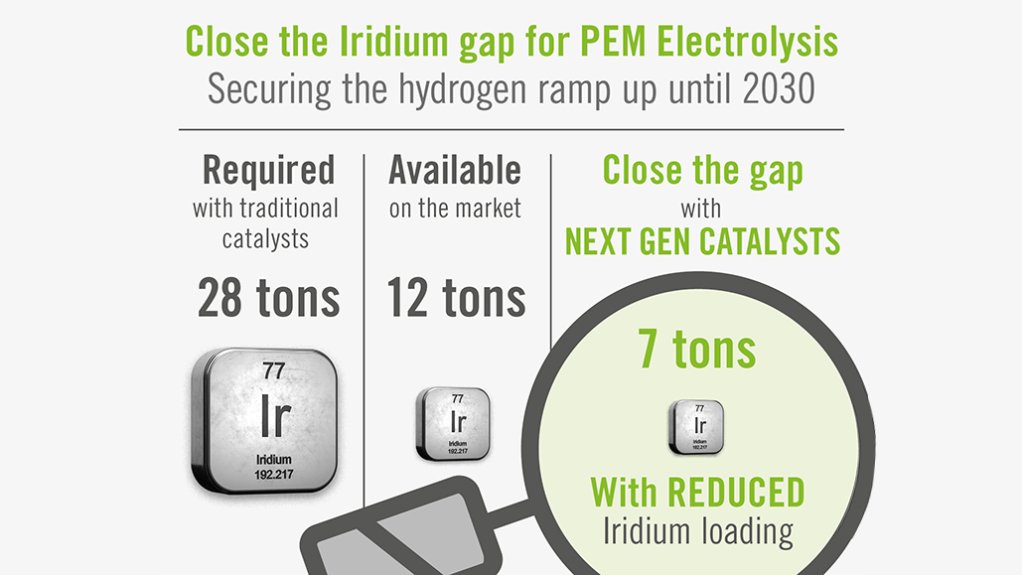

The globally active Heraeus adds in its 2026 forecast just out that a return to demand growth in the hydrogen sector is anticipated, though it is not yet clear how much this will impact the iridium market, which the Hanau-based company expects to trade at between $3 800/oz and $5 150/oz in 2026.

With PGM prices being much higher than at the start of 2025, South African mining companies now have much better margins and some small projects ramping up are adding small amounts of iridium to South African output, Heraeus, which has a long-standing South African presence, points out in a release to Mining Weekly.

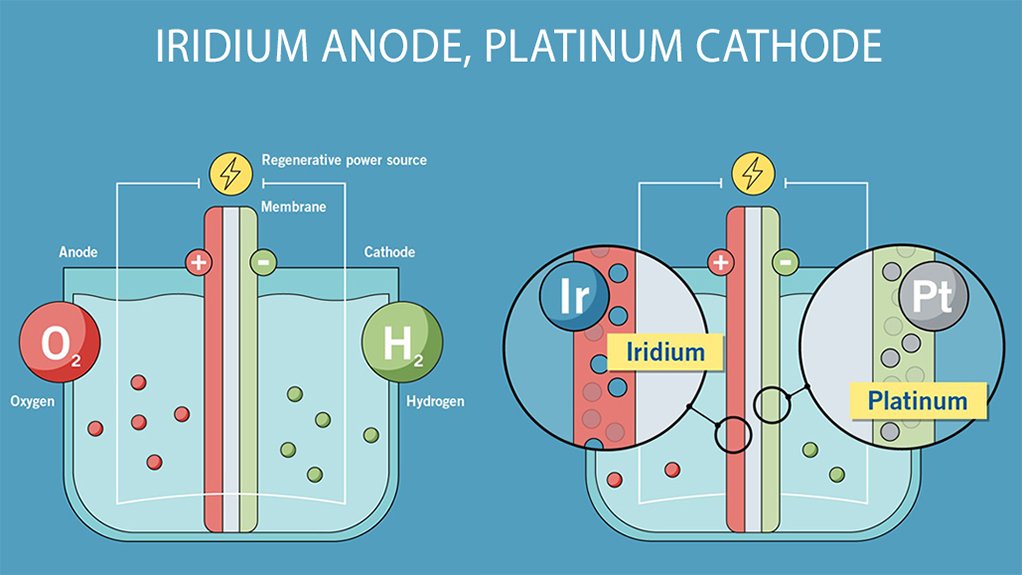

Being used along with iridium in green hydrogen electrolysers is ruthenium, another PGM, which is also being used in a variety of other hydrogen-related processes.

Within the push to further develop green hydrogen, China’s Five-Year Plan from 2026 to 2030 seemingly includes hydrogen-powered fuel cell electric vehicles and the ruthenium price is forecast to trade between $600/oz and $975/oz in 2026.

The Heraeus report estimates that platinum is estimated to trade at between $1 300/oz and $1 800/oz in 2026, when platinum’s deficit is expected to shrink.

South Africa’s platinum output is predicted by Heraeus to be somewhat higher in 2026, partly owing to the processing of work-in-progress stock that was built up during processing plant maintenance, and partly owing to the ramp-up of some new operations.

The recovery in PGM prices during 2025 improved the mining companies’ margins which makes further cuts to production unlikely.

Secondary recycled platinum supply is anticipated by Heraeus to rise modestly next year. In Europe, scrap autocatalyst volumes are predicted to rise with heavy-duty vehicle sales forecast to see robust growth globally, leading to greater numbers of scrapped commercial vehicles.

Primary palladium production is forecast to increase by 1% to 6.2-milion ounces next year and the rally in the PGM prices has helped to uplift secondary palladium supply.

Industrial use of rhodium is projected by Heraeus to rise modestly next year amid moderate growth in the chemical sector and marginally higher primary supply.

Secondary rhodium supply is predicted by Heraeus to rise in 2026 when rhodium prices are expected to be between $6 000/oz and $9 000/oz.

Heraeus, which covers the value chain from trading to refining and recycling, has extensive PGM insight.

Key hydrogen systems of Heraeus group laboratories went live in China in October, where rapid growth is reported in the platinum-catalysed proton exchange membrane (PEM) green hydrogen technology that is poised to play a central decarbonisation role.

The laboratories were described as reflecting China’s rapid pace of hydrogen innovation.

The cost-efficient production of green hydrogen – on the industrial scale that China can provide – will be an important contributor towards a zero-emission society, on a planet increasingly threatened by climate disruption.

A return to demand growth in the hydrogen sector is anticipated by Heraeus in its 2026 forecast report, which points to some Chinese companies having developed PEM electrolysers.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here