JOHANNESBURG (miningweekly.com) – Mining’s standout 2025 performance was in “other metallic minerals”, Minerals Council South Africa reports.

Owing to the exceptional 17.2% higher 2025 production performance, this subsector, which includes silver, cobalt, lead, titanium and zinc, is now being viewed as one which is worth monitoring.

What Minerals Council South Africa describes as ‘bottom line’ is the South African mining sector's display of distinctive divergence in 2025 amid China requiring record volumes of steel‑linked iron-ore, manganese, chromium and transition metals.

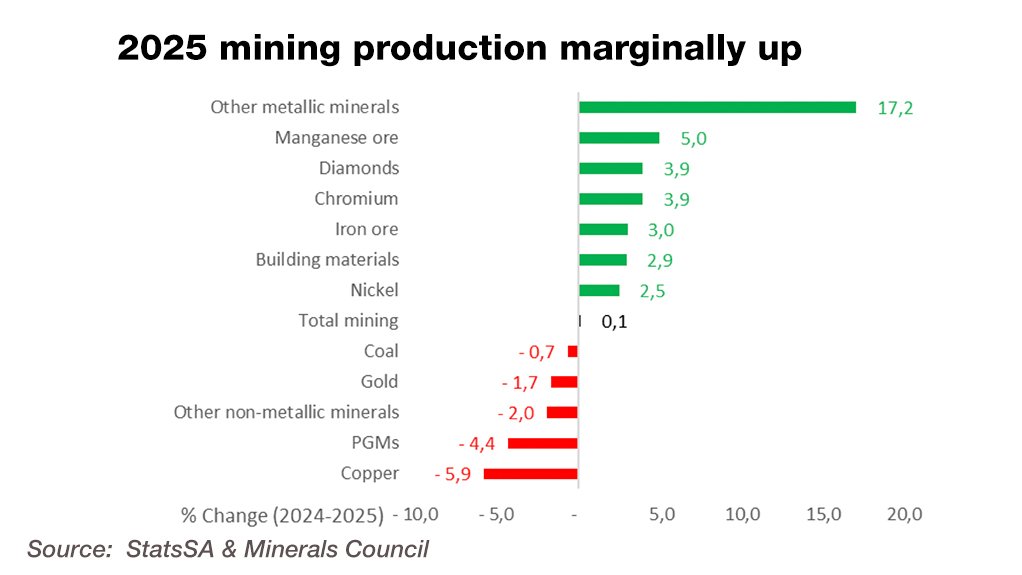

Headlined is the masking of divergent trends by the marginal 0.1% overall 2 mining production increase.

Lower production centres on traditional revenue anchors such as platinum group metals (PGMs), gold, and coal, while production growth was driven by bulk commodities and emerging metallic minerals. (Also see infographics accompanying this report.)

Mining’s resilience, Minerals Council South Africa points out, reflects structural shifts in demand and production, with implications for competitiveness, energy use, and policy.

Commodities that registered production growth in 2025 over 2024 were:

- iron-ore (+3.0%), manganese (+5.0%), chromium ore (+3.9%), which are commodities linked to China’s 2025 steel exports reaching a record 119-million tonnes, 7.2% higher than in 2024.

- diamonds with a 3.9% production increase seen as a sign of slight luxury market recovery.

- building material production being up by 2.9% on probable construction-linked recovery.

At the lower end of the production scale were PGMs, which were down 4.4% owing to prices negatively affecting production until May 2025 – and then rains impacting production from October to December.

The 1.7% decline in gold production is viewed as being largely geological, while coal’s 0.7% lower output is seen as likely reflecting slightly lower domestic demand. Export volumes were a marginally higher 71.9-million tonnes.

GOOD PRECIOUS METALS PRICES

The 2025 $3 440/oz gold price was 44.1% up on that of 2024. Platinum was also a 34%-higher $1 279.8/oz, palladium a 17%-higher $1 150.4/oz, and rhodium, a 35.3%-higher $6 258/oz.

At the declining end of the commodity price scale was coal at a 14.9%-lower $90.4/t and iron-ore at a 6.6%-lower $103.7/t.

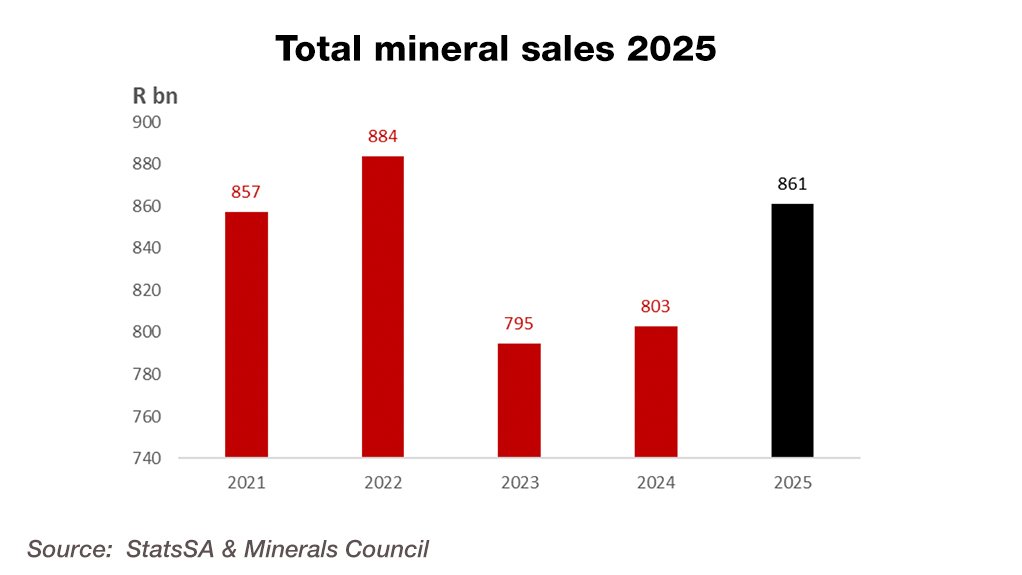

One of the infographics accompanying this report show 2025 mineral sales returning to nigh 2022 levels, with gold sales 29.7% higher at R185-billion, PGMs 19.5% higher at R206.7-billion, chromium ore 3% higher at R65.4-billion, and copper a 9.4% higher R7.7-billion.

Coal sales were 3.1% down at R194.3-billion, iron-ore sales fell 8.7% to R83.5-billion, manganese sales were 1.8% lower at R49.1-billion, and nickel sales fell by 8.9% to R8.9-billion.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here