JOHANNESBURG (miningweekly.com) – The demand-surpassing production of metallurgical coal, in spite of the availability of environment-friendly alternatives for steelmaking in particular, is highlighted in the launch of a metallurgical coal exit list that goes beyond the thermal coal exit list first published in 2017 and focuses on new metallurgical coal mine plans and expansions.

The metallurgical coal exit list is published by Urgewald, Reclaim Finance, BankTrack, SteelWatch, Global Energy Monitor, Coal Action Network, Coal-Free Finland, Nordic Center for Sustainable Finance, Ecodefense, Rainforest Action Network, and The Sunrise Project.

Urgewald director Heffa Schuecking emphasises in a release to Mining Weekly that technologies now available allow for the phasing out by the early 2040s of steel-sector metallurgical coal and urges financial institutions to stop bankrolling expansion of the metallurgical coal industry, amid the iron-and-steel sector being responsible for 11% of global CO2 emissions.

The Critical Raw Material Alliance is quoted as acknowledging a 37% surpassing of demand as a result of many of the largest metallurgical coal mining companies continuing to advance new production, regardless of crucial climate change imperatives needed to cut back on the use of coal.

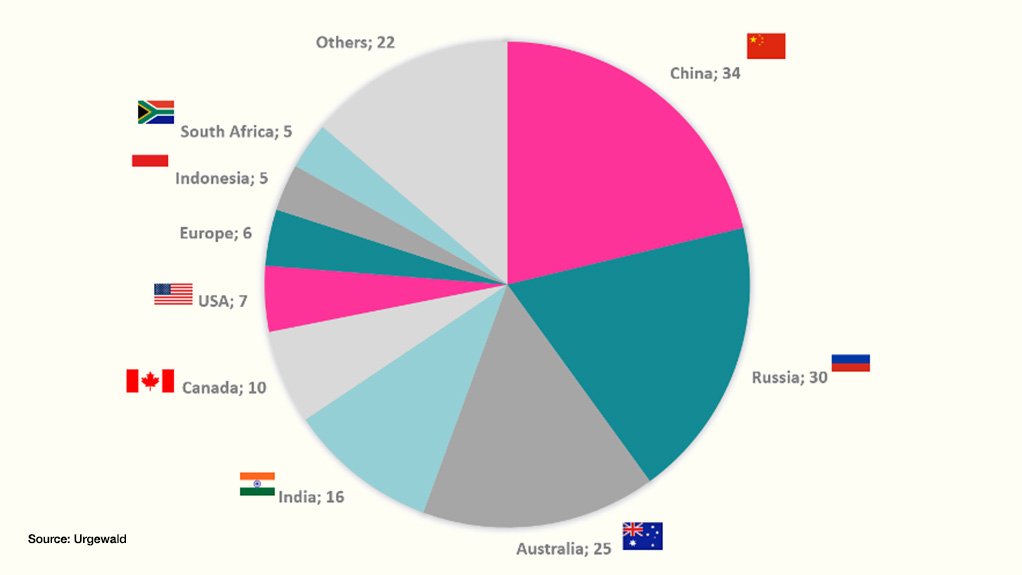

The metallurgical coal exit list identifies 160 mining companies that are pursuing 252 metallurgical coal expansion projects in 18 countries, with planned enlargement poised to increase current production by 50% through the provision of 551-million more tonnes a year.

“Our data reveals that most metallurgical coal expansion projects – and the companies behind them – are concentrated in Australia, Russia and China. Australia is the world’s metallurgical coal exporter, and India and Japan are among the primary destinations of its exports,” Urgewald states.

A joint venture involving a Sydney-, London- and Johannesburg-listed major, Urgewald adds, plans to extend the life of the Peak Downs mine in Australia by 93 years. If approved, the mine would continue operating until 2116, which places a significant question mark over public company commitment to achieving a net-zero carbon emission position by 2050.

Urgewald reports that metallurgical coal can be up to three times more polluting than thermal coal, which the UK government had to acknowledge when the UK High Court in September overturned its decision to approve a new metallurgical coal mine. Burning the extracted coal for steel production would have unleashed carbon emissions equal to more than half of the UK's total 2022 emissions.

While 183 financial institutions have adopted policies on thermal coal, the non-governmental organisation Reclaim Finance is quoted as finding that only 16 financial institutions have policies covering metallurgical coal, out of which 11 are banks, four are asset managers and one is an insurer. Three of these financial institutions are from Australia and the rest are headquartered in Europe.

While the scope of most metallurgical coal policies is limited to direct project finance, Reclaim Finance’s research indicates that project-level financing represents only a tiny proportion of total financing received by companies with metallurgical coal expansion plans.

The Swiss insurer Zurich is identified as having adopted one of the best metallurgical coal policies in that it excludes new metallurgical coal mines as well as the companies developing them.

Urgewald metallurgical coal research head Lia Wagner calculates that metallurgical coal represents almost 13% of total coal production and that financial institutions need to address what she describes as a "gigantic blind spot in their coal policies".

Reclaim Finance private finance campaigner Cynthia Rocamora states that there is no reason, scientific or otherwise, to deem metallurgical coal less risky or more desirable than thermal coal.

"From a climate perspective, coal is coal and must be phased out regardless of its end use. The technologies to decarbonise steel production are available and are already being deployed by first-movers in the industry. Financial institutions must support the transition to coal-free steel instead of backing companies that are developing new dirty met coal mines,” Rocamora adds.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here