South Africa’s central bank chief has given the country’s local-currency bonds another reason to add to their market-leading returns.

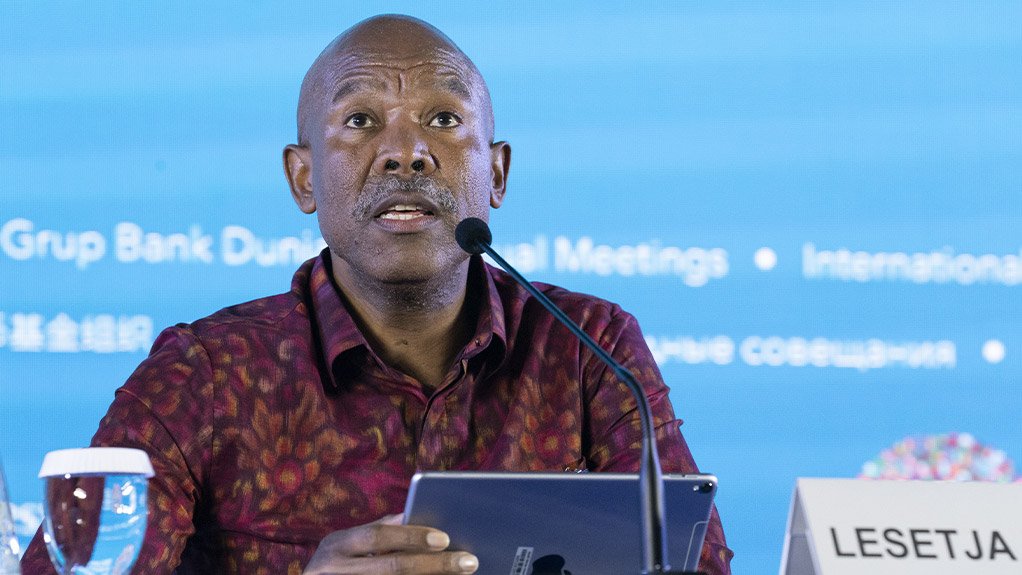

Investors are piling into the debt after South African Reserve Bank Governor Lesetja Kganyago argued strongly on Thursday for a reduction of the inflation target which, he said, would boost growth and lead to lower interest rates in the long term. Yields on 10-year government bonds plunged 16 basis points, and extended the drop on Friday to a six-month low.

The bonds were already riding a wave of positive sentiment in favour of emerging-market local debt as the dollar weakens and investors look for alternatives to US assets. A fiscally conservative budget following months of wrangling over a proposed increase in value-added tax, together with inflation slowing to near five-year lows, provided additional tailwinds.

Tightening the inflation target “would be positive for the bond market,” said Sergei Strigo, a portfolio manager and co-head of emerging-market debt at Amundi. He sees room for more interest-rate cuts this year after the SARB resumed its easing cycle this week.

“We are positive on South Africa local-currency bonds,” Strigo said. “Recent inflation dynamics, higher gold prices, strong rand are all positive factors for the bond market. The yield curve is still very steep, so there is room for long-end yields to compress.”

South African government debt has returned 7.2% in dollar terms in May, far outstripping other major emerging markets tracked by Bloomberg indexes. The next-best performer was Turkey, at 4.3%, and the average for developing-nations was just 1.2%.

Kganyago dropped the inflation-target bomb after lowering the repo rate by 25 basis points to 7% on Thursday. While a lowering or narrowing of the 3%-6% target is not a done deal — it would be a politically fraught move and Finance Minister Enoch Godongwana has expressed opposition to it — the market is already positioning for the adjustment.

“Bonds had cheapened materially given political and budget-related uncertainty, so there was room for a retracement lower in yields,” said Samir Gadio, head of Africa strategy at Standard Chartered. “Then we had the boost effect from the MPC meeting given the way the inflation-targeting discussion was framed.”

The central bank’s research shows that fixing the target at 3% would lead to a repo rate below 6%, a percentage point lower than it is now. While economic growth would initially slow, it would pick up above current forecasts from 2027, Kganyago said.

With money markets already pricing in two additional rate cuts this year, investors may be getting ahead of themselves, said Michael Grobler, a fixed-income strategist at Ashburton Fund Managers. A weak growth print next week could delay a decision to lower the target, he said.

“But I am not bearish on South African bonds given the policy decision to move to a lower target is bond supportive on a two-year outlook,” he added.

The yield on benchmark 2035 securities fell one basis point on Friday to 10.16%, the lowest on a closing basis since Nov. 29. The yield is down 97 basis points from a year-to-date high in April.

EMAIL THIS ARTICLE SAVE THIS ARTICLE FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here