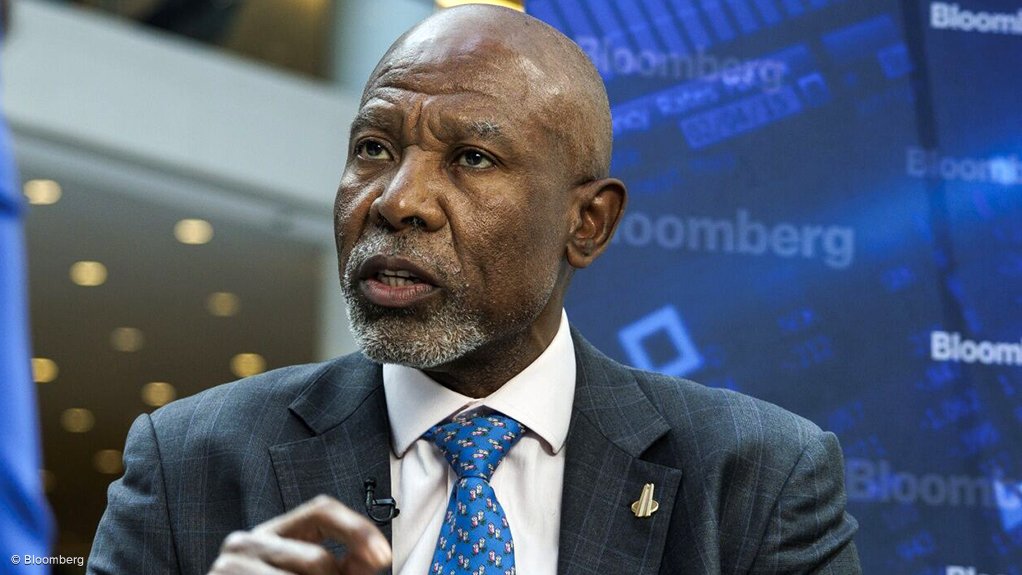

South African Reserve Bank (Sarb) Governor Lesetja Kganyago reinforced his argument for adopting a lower inflation target, noting that the current goal hurts the rand and allows prices to march higher.

“Although an inflation rate of 4.5% may seem moderate, it still causes prices to double every 16 years,” Kganyago said in the Sarbs’s annual report published Monday. “This is hard to reconcile with our constitutional obligation to safeguard the value of the currency.”

The central bank prefers to anchor inflation expectations at the midpoint of its 3% to 6% target band, which is currently under review.

Kganyago’s remarks mark his latest effort to sway the debate toward lowering the goal with the central bank advocating for 3%. South African inflation rate was 2.8% in May.

The low level of inflation offers South Africa an “amazing” opportunity to adjust a framework that hasn’t been revised since it was introduced in 2000, David Fowkes, a member of the bank’s monetary policy committee, said earlier this month.

“The main concern with South African inflation is not our ability to hit the target,” Kganyago said. “Rather, it is that our target is high compared to other countries. For this reason, despite our success in stabilising inflation, the price level is almost 20% higher than it was in 2021.”

A joint Sarb and Treasury team is “almost done” with technical work on the review and will present recommendations soon to Kganyago and Finance Minister Enoch Godongwana, the Sarb said.

According to the bank’s modelling, shifting to a 3% target would yield significant benefits, with inflation expectations declining quickly while “borrowing costs would fall more significantly” compared to the Sarb’s baseline forecast.

EMAIL THIS ARTICLE SAVE THIS ARTICLE FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here