JOHANNESBURG (miningweekly.com) – Johannesburg Stock Exchange-listed Exxaro Resources will be spending R5.2-billion on a life-of-mine expansion project at its Matla colliery and R4.7-billion on the development of the 140 MW Karreebosch wind energy project.

Matla will basically provide a new mine and the wind farm’s supply of clean energy to platinum group metals mining company Northam Platinum will come with Scope 3 emission credits as Exxaro executes on its decarbonisation roadmap.

Being an Exxaro coal customer, Northam will support the reduction of Exxaro’s Scope 3 emissions obligations through the Karreebosch wind energy project arrangement.

Despite persistent global and domestic headwinds, new Exxaro CEO Ben Magara reported a good set of dividend-yielding interim results that saw net cash rise 27% to R12.4-billion.

Magara made the point that this level of cash buffer would not be retained once the purchase of Ntsimbintle Holdings and OMH manganese assets was brought to completion, which was expected to take place in the first quarter of next year.

Of the R3-billion dividend funding, R1.7-billion was a pass-through from the Sishen Iron Ore Company dividend and R1.3-billion from Exxaro’s own-managed operations.

Half-year domestic and export coal sales were 1% higher on production of 19.4-million tonnes.

The operating wind assets of Exxaro’s energy solutions company, Cennergi, generated 337 GWh of electricity in the six months to June 30, amid the signing of a power purchase agreement for Northam Platinum to receive clean power from the Karreebosch Wind Farm, a project that will uplift the gross clean power capacity Cennergi to 437 MW.

Combined with Exxaro’s Lephalale solar project, the two projects will more than double Cennergi’s capacity by the first half of 2027.

The half-year revenue of Cennergi rose 3.5% to R675-million on stable generation and increased annual tariff escalations, which uplifted the operational earnings of the wind energy business to R537-million – “and this drive is not just about money, but it’s also about reducing emissions”, said Magara.

Expansion capital of R1.1-billion was spent on the Lephalale solar project and the Karreebosch Wind Farm in the half-year, FD Riaan Koppeschaar reported.

Exxaro is configuring its assets to support its decarbonisation journey, with a particular focus on technologies such as fleet optimisation to reduce Scope 1 emissions.

A key milestone in this commitment is the commissioning of the self-generation Lephalale solar project initiative at the Grootegeluk coal mine, which will deliver a 25% reduction in Scope 2 emissions and a 17% reduction in total Scope 1 and Scope 2 emissions.

Addressing Scope 3 value-chain emissions remains a priority, and through strategic partnerships and meaningful stakeholder engagement such as the signing of a memorandum of understanding with Eskom in April, Exxaro expressed confidence that it would make progress in reducing these emissions.

MORE DOMESTIC COAL OFFTAKE EXPECTED

Exxaro is expecting more of its coal to be bought by Eskom, especially in view of the fourth unit of the Medupi power station that it supplies, having been returned to service.

“We were very pleased when they announced a few weeks ago that unit four is back,” said Magara during the presentation of half-year results covered by Mining Weekly.

Each unit consumes around 2.2-million to 2.3-million tons of coal.

“When a unit’s down for a year, that's 2.2-million to 2.3-million tons out of your production and that impacts unit costs,” said Magara, adding that all six Medupi units now seemed to be running.

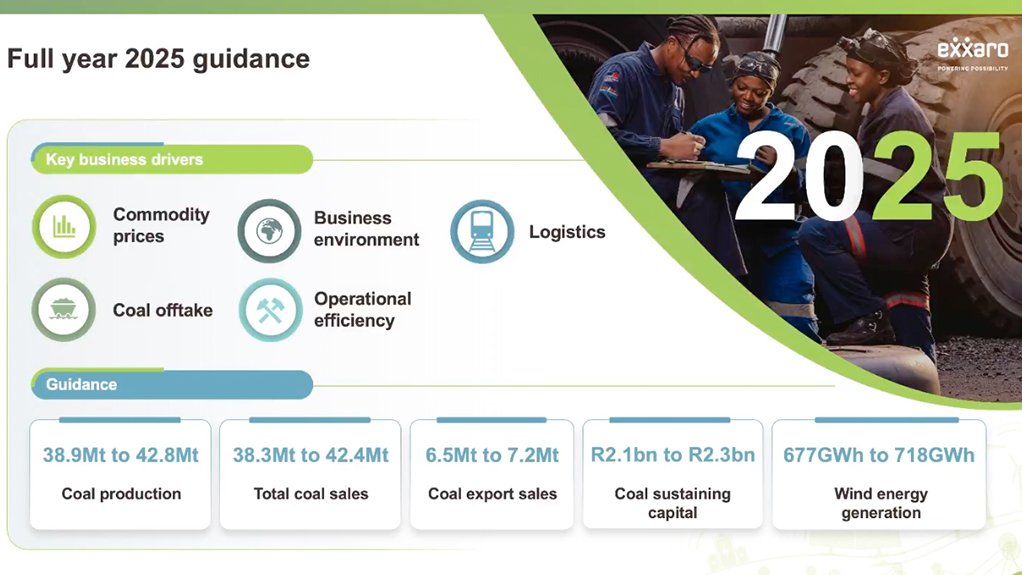

As a result, Exxaro is guiding total 2025 production of around 38.9-million tons to 42.8-million tons, and total coal sales of between 38.3-million tons and 42.4-million tons, with export sales ranging possibly between 6.5-million tons and 7.2-million tons. Exports will depend on continued improvement by Transnet and favourable prices that justify multi-modal logistics.

On the clean energy side, generation of 677 GWh to 718 GWh would come from wind energy alone, owing to the delays of the Lephalale solar project.

“We aim to transform Exxaro into a diversified natural resources champion in Africa and beyond. As indicated in our various announcements in the last six months, we’ve taken decisive action to deliver on our strategy.

“We have a strong coal base, and that will continue. We have quality investments in iron-ore and base metals, and we’ll be prudently scaling up our energy business, adding energy transition metals to our portfolio as well, to create the sustainability we need for our country, for our continent, and for our shareholders and all stakeholders,” said Magara.

“The life-of-mine expansion project at Matla colliery will basically provide a new mine with office infrastructure, change-house facilities and a ventilation shaft. This project is on schedule, within budget and on target.

In manganese, Exxaro’s transaction in May gains stakes in Ntsimbintle (74%) giving Exxaro 60.1% effective ownership in Tshipi Borwa mine, including 50.1% marketing rights, Jupiter Mines (19.99%), Ntsimbintle Marketing and Trading (100%), Mokala Manganese (51%), and Hotazel Manganese Mines (9%), for a purchase consideration of R11.67-billion, rising to R14.68-billion with tag-along rights and escalations.

Post the announcement, Ntsimbintle shareholders have approved the transaction. The escrow, warranty and indemnity insurance agreements have been entered and a submission filed to the South African Competition Authority for Tshipi Borwa mine. Submission for Ministerial approval under section 11 of the Mineral and Petroleum Resources Development Act has also been completed.

“We have strengthened our ability to deliver clean, reliable energy solutions to our customers, contributing meaningfully to South Africa's just energy transition.

“We expect the first electrons from the Lephalale solar project in first half of 2026. The completion of the Lephalale solar project will see Grootegeluk coal mine benefiting from both electricity cost savings and reducing our Scope 2 emissions.

“We remain focused on the operational delivery, which is really the bedrock that allows us to get the cash generation we need for our growth,” said Magara, who reported that the team conducting the Leeuwpan Colliery turnaround plan had concluded consultations within the legislated 60-day timeframe, reflecting strong collaboration between Exxaro management teams, organised labour stakeholders, employee representatives and all Leeuwpan employees.

Discussions with Transnet are also under way to look at alternative export channels to minimise job loss.

“Upon the close of our manganese deal, we have no intention to rebuild our cash buffer to current levels. In that regard, we’re reviewing our capital allocation framework to enhance returns to our shareholders within our company's risks.

“We’re committed to sustained strategic value unlock and we’ve unveiled a group management structure that is fit for the future within a functional operating model.

“Our focus is really to drive and resource this organisation for growth but also represent the demographics of our country with qualified, competent, capable people. We must ensure that we bring everyone along, including our communities,” said Magara.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here