Eskom Group CEO Dan Marokane has outlined an “aspirational” new generation capacity profile to 2040, showing that the State-owned entity has an ambition to progressively replace its aged and polluting coal fleet with new and cleaner technologies.

No project details or funding plans have been provided, however, with Eskom confirming only that the capacity profile was “indicative” and included “aspirational and unfunded projects”.

Capital expenditure figures were also not indicated and no individual projects were identified.

Having previously declared that Eskom had a 22 GW project portfolio, Marokane told members of the Portfolio Committee on Electricity and Energy that the generation division, which is yet to be unbundled, was “working on a pipeline of new clean energy to ensure security of supply in the long term”.

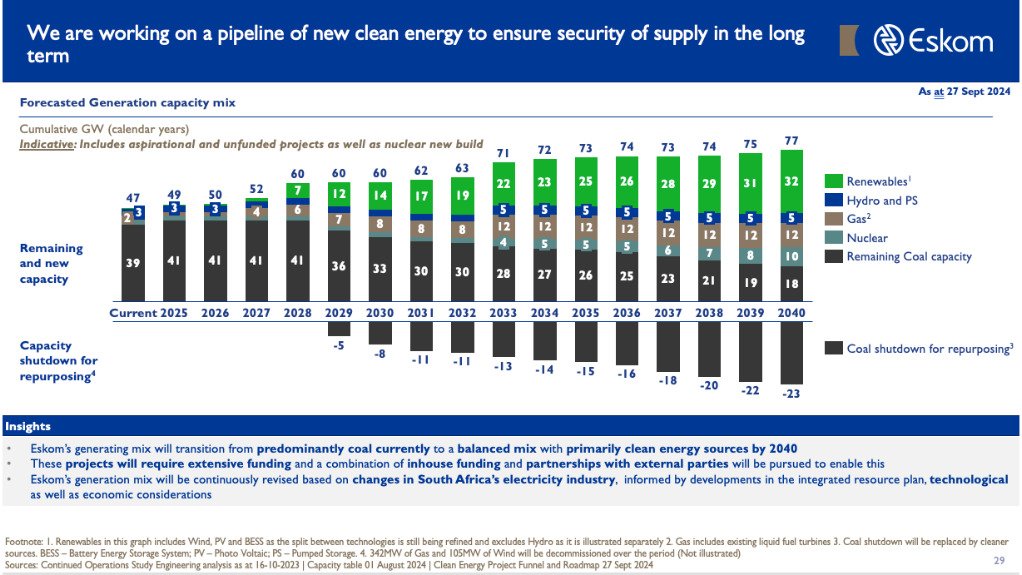

A slide included in the presentation shows that Eskom aims to progressively replace its coal fleet with wind, solar PV, battery and pumped-hydro storage, as well as with gas-to-power and even new nuclear.

Having received permission at the height of the country’s loadshedding crisis to delay, until 2030, the decommissioning of several coal stations that were initially scheduled to close by 2025, the slide also includes an updated decommissioning profile.

It shows that 11 GW of coal generation will be shut by 2031, rising to 23 GW by 2040, but the names of individual stations or units at those stations were not included.

It also shows Eskom’s nameplate generation rising from a nominal 47 GW currently to an “aspirational” 77 GW by 2040, but with a materially different mix.

Eskom is currently trading under conditions set as part of a R250-billion debt-relief package, which was reduced from R254-billion after Eskom failed to dispose of noncore businesses in the timeframe stipulated by the National Treasury.

The taxpayer support also came with a condition disallowing Eskom from raising any new debt for new generation projects.

The pipeline outlined also did not align with the recently remodelled Integrated Resource Plan assumptions released by the Department of Mineral Resources and Energy.

That remodelling carries an assumption that Eskom could add 5.1 GW by 2030, including capacity associated with the yet-to-be-completed Kusile power station and a 3 GW gas project in Richards Bay for which it has received a Ministerial determination.

Eskom’s slide indicates that renewable and battery storage capacity alone could amount to 14 GW by 2030, but again no funding details were provided.

Marokane also provided an update on some key generation projects, which could introduce an additional 2 524 MW of capacity by the end of March.

He confirmed some delays with the completion of Kusile Unit 6, as well as the return to service of Koeberg Unit 2.

Kusile Unit 6 is now expected to synchronise to the grid in January, which is when the Koeberg reactor is also now expected to return, while Medupi Unit 4 is said to be on track for a return in March.

Significant attention will also be given to whether the three Kusile units currently operating using temporary stacks that bypass the flue gas desulphurisation (FGD) plant will be returned as planned.

The temporary stacks were installed after a flue duct collapsed in October 2022, which left the three units that shared a common chimney inoperable. The units were given permission to bypass the FGD plant until the end of March.

The impact of the delays has been somewhat softened, however, by the materially improved performance of the rest of the coal fleet, which has allowed Eskom to operate loadshedding-free since March 25.

Marokane said Eskom’s energy availability factor (EAF) had improved by 8.41 percentage points year-on-year, but told lawmakers that it might still end the year “slightly below the 65% EAF target”.

“Eskom is turning the corner in terms of its operational and financial performance, although there is still further work required to ensure the sustainability of the industry,” he said.

Of particular concern was the ongoing rise in municipal arrear debt, which had risen to above R92-billion by the end of October, an increase of R19.34-billion since the start of the group’s financial year on April 1.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here