South Africa's finance minister has said that failing to raise the value-added tax rate from May would cause severe harm to state finances, court papers showed, after a stand-off over the proposal risked the stability of the coalition government.

The two biggest parties in the coalition government, the African National Congress (ANC) and the Democratic Alliance (DA) have been at odds over the proposal to raise VAT by 0.5 percentage points on May 1 and another 0.5 points next year.

VAT is currently at 15%.

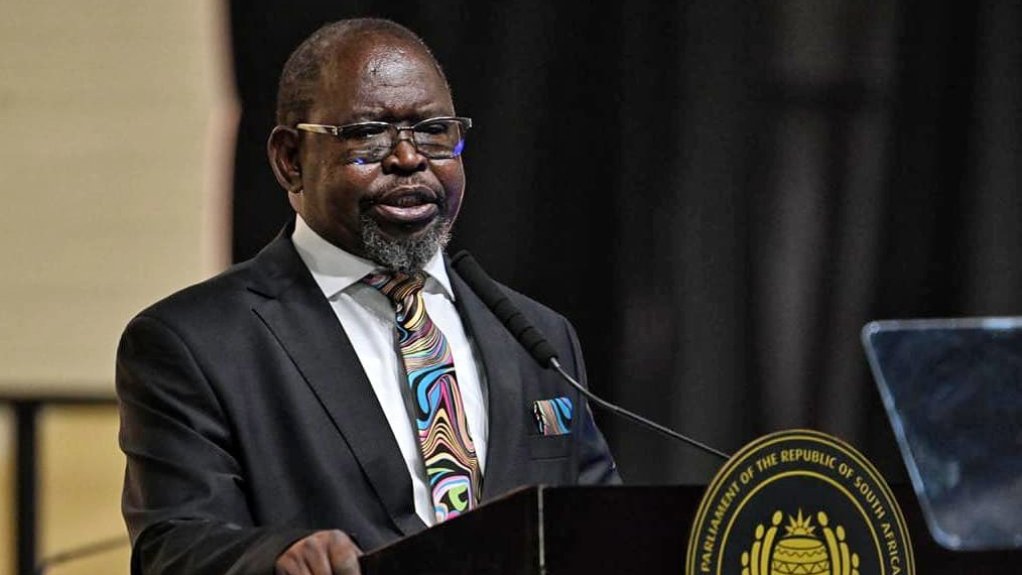

In response to the pro-business DA challenging the legality of the VAT hike plan in court, Finance Minister Enoch Godongwana argued that any delay or removal of the VAT hike would have dire consequences on the country's finances.

"If the rate increase is halted now, that revenue will be lost, and the state will be left without the funds needed to meet already-budgeted spending commitments," Godongwana said in papers lodged with the court on Wednesday.

"The consequences would be severe and far-reaching. Government would be immediately forced either to cut expenditure or to increase borrowing."

Lawmakers have the power to amend or withdraw the impending VAT hike through upcoming budget votes.

Some smaller political parties have put forward proposals that would include deeper expenditure cuts instead of a VAT hike.

Local news headlines last weekend had suggested the ANC was likely to drop its insistence on a VAT hike this year after indications that none of the parties it had been talking to would support it.

Godongwana also conceded on state broadcaster SABC on Wednesday that wrangling over a 0.5 percentage point increase in VAT might not be in the broader public interest.

South Africa's National Treasury estimates that raising VAT will generate about R13.5-billion in additional revenue for the 2025/26 financial year.

EMAIL THIS ARTICLE SAVE THIS ARTICLE

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here