- The draft regulations released for public comment on April 32.18 MB

In yet another step towards clearing the path for South Africa’s inaugural procurement of independent transmission projects (ITPs), draft regulations have been published for a 30-day public comment period.

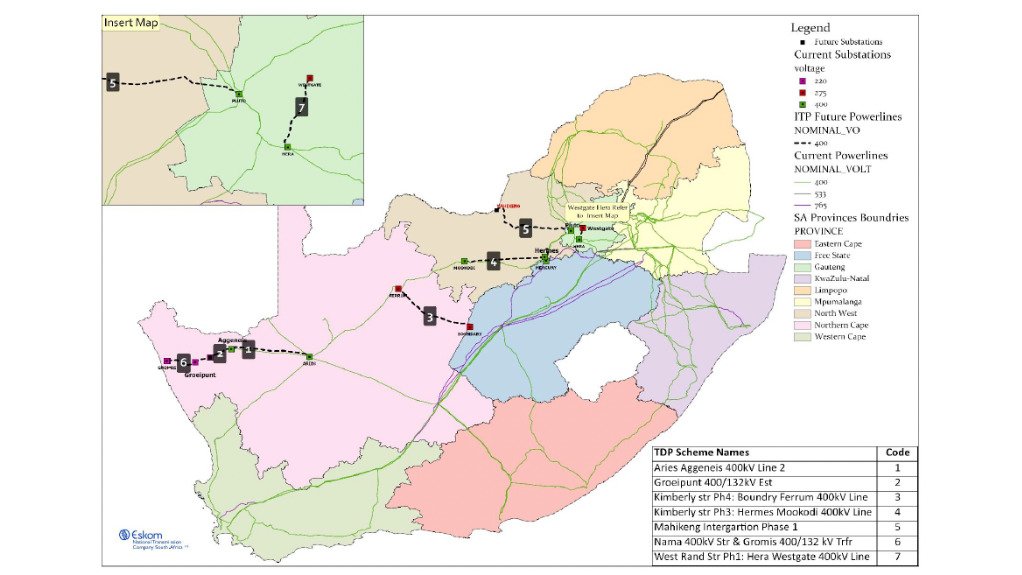

Their release follows a Ministerial determination by Electricity and Energy Minister Dr Kgosientsho Ramokgopa opening the way for the procurement of the first phase of the ITPs, involving 1 164 km of 400 kV powerlines and 2 630 MVA of transformers across seven projects in three provinces.

Government plans to pursue a two-stage procurement process, with a request for qualifications in July aimed at prequalifying bidders ahead of the November launch of a full-blown request for proposals.

Before then, regulations under Section 35(4) of the Electricity Regulation Act also must be finalised to facilitate the procurement.

These regulations will outline the terms of transmission service agreements between the ITP and the buyer, which will be the National Transmission Company South Africa (NTCSA) - the legally separated division of Eskom Holdings, with its own board and executive.

They will also contain the cost-recovery mechanism to be used to enable the NTCSA to pay the ITP for the financing, construction, operation and maintenance of the infrastructure over the concession period, while earning a “fair” return.

That period, as well as the preferred procurement model are still to be determined, but Ramokgopa has indicated that its recently conducted market-sounding exercise points to there being appetite for some form of build, operate, own and transfer model or build, operate, transfer model.

Ministerial adviser Shaakira Karolia tells Engineering News that the Department of Electricity and Energy, which is now operating separately from the previous Department of Mineral Resources and Energy, is eager to receive feedback from stakeholders.

She says that having sound regulations is crucial for creating the “predictable, credible and transparent framework” required for private-sector participation in the expansion of the country’s transmission infrastructure.

FIRST PROJECTS

While the NTCSA will continue with its own build programme, government believes ITPs are required to accelerate the financing and build-out of the grid, particularly in areas where there is insufficient capacity to connect new renewable-energy generators.

This backlog is reflected in the seven pre-selected projects, namely:

- The 200-km Aries-Aggeneis 400 kV powerline, in the Northern Cape;

- The 126-km Groeipunt 400 kV powerlines upgrade, with 500 MVA of transformers, in the Northern Cape;

- The Kimberley strengthening Phase 4 project, involving the 265-km Boundary-Ferrum 400 kV overhead line, in the Northern Cape;

- The Nama strengthening and Gromis projects, in the Northern Cape, involving 117 km of powerlines and 1 000 MVA of transformation capacity;

- The 180-km Mahikeng Integration Phase 1 development, with 630 MVA of transformation, in the North West province;

- The 240-km Mookodi-Hermes 400 kV powerline, in the North West province; and

- The 36-km Hera-Westgate 400 kV powerline and 500 MVA of transformation capacity, in Gauteng.

Together the seven projects are expected to unlock 3 222 MW of additional renewable-energy generation when they enter into commercial operation in stages during 2029 and 2030.

The projects themselves have been selected from the NTCSA’s Transmission Development Plan and are all at an advanced stage of development, with regards to servitude acquisition and environmental approvals. The NTCSA has also appointed an ITP project manager to facilitate the programme.

In addition, the Independent Power Producer Office, which has developed significant procurement capabilities since 2011, will be the procurement agent for the initial ITPs, owing to its experience in managing bidding processes and advancing projects to financial close.

CREDIT GUARANTEE VEHICLE

Karolia reports that, besides finalising the regulations, work is also progressing with the National Treasury and the World Bank Group to prepare for the launch, in early 2026, of a new credit guarantee vehicle (CGV), to help derisk the projects for investors without further burdening the fiscus.

The blended-finance instrument will seek to act as a substitute for sovereign guarantees in covering payment and termination risks by leveraging development, multilateral development bank, political-risk insurance and grant finance.

The idea is to pilot its deployment during the first ITP phase before extending it to other infrastructure areas.

“The estimated funding requirement on the CGV is about $500-billion at its initial startup and then scaling it up over the next decade,” she tells Engineering News.

However, Karolia stresses that, while the regulations and the CGV represent key milestones, there are many other related policy and implementation initiatives under way to ensure progress ahead of procurement and the success of the first projects.

Localisation and empowerment are also receiving priority attention, with a phased approach likely to be adopted, particularly given that South Africa lacks both capabilities and capacity in certain areas, particularly in the production of large transformers.

“Ultimately, localisation has not worked previously because of weak and inconsistent demand from State-owned enterprises. In the medium- to long-term, we are aiming to ensure that those mistakes are not repeated with the ITPs.”

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here