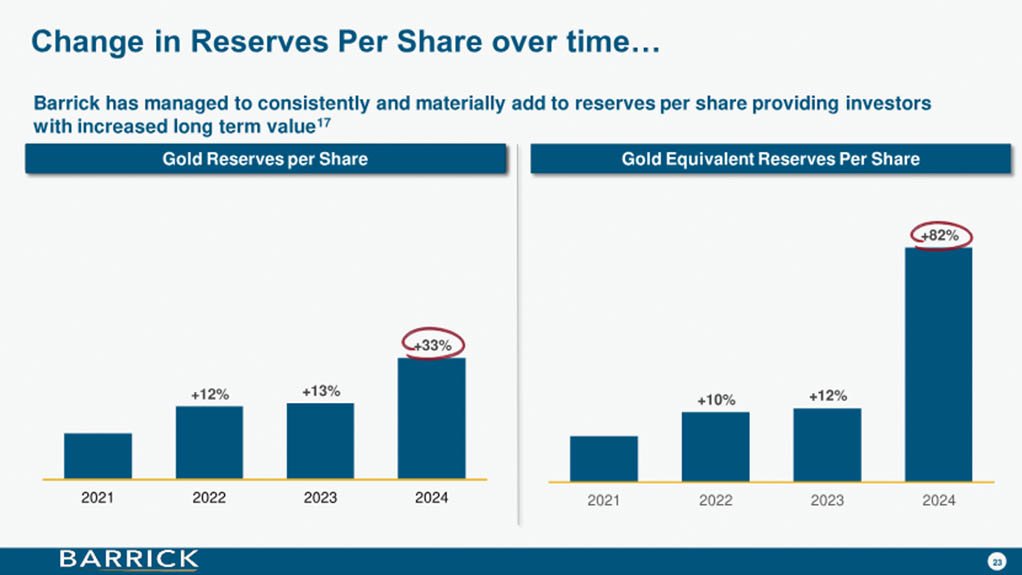

JOHANNESBURG (miningweekly.com) – The foundation of a real mining company lies in its reserve base, Barrick Mining highlighted during Wednesday’s quarterly results presentation when it displayed a slide that brought into sharp focus the far-reaching extent to which the company has managed to consistently and materially add to reserves per share that provide investors with increased long-term value.

Most interestingly, Barrick’s exceptionally promising growth assets require neither new debt nor share dilution. (Also watch attached Creamer Media video.)

Remarkably, while the hugely successful exploration engine is active in every major mineral belt, the company continues to pay out quarterly dividends.

On the complete contrary to new equity being issued, share buyback is continuous as is ongoing growth investment, balance sheet bolstering, and the instilling of very credible confidence that the best is yet to come.

Last year, gold reserves per share rose by 33% and gold equivalent copper inclusive reserves per share copper by 82%, and this was done overwhelmingly through exploration and not mergers and acquisitions (M&A).

Very frugally, Barrick continues to lead the industry in replacing and growing reserves “through the drill bit and not through overpriced M&A”, Barrick CEO Dr Mark Bristow reported.

What is astounding is that since 2021, 111-million gold equivalent ounces of reserves have been added at a cost of just $10 per gold equivalent ounce, compared with M&A deals in the sector averaging over $440 per ounce, and in some cases more than double that.

“It's a disciplined strategy that underpins our growth plans and reinforces the long-term value of our business,” Bristow emphasised during the presentation covered by Mining Weekly.

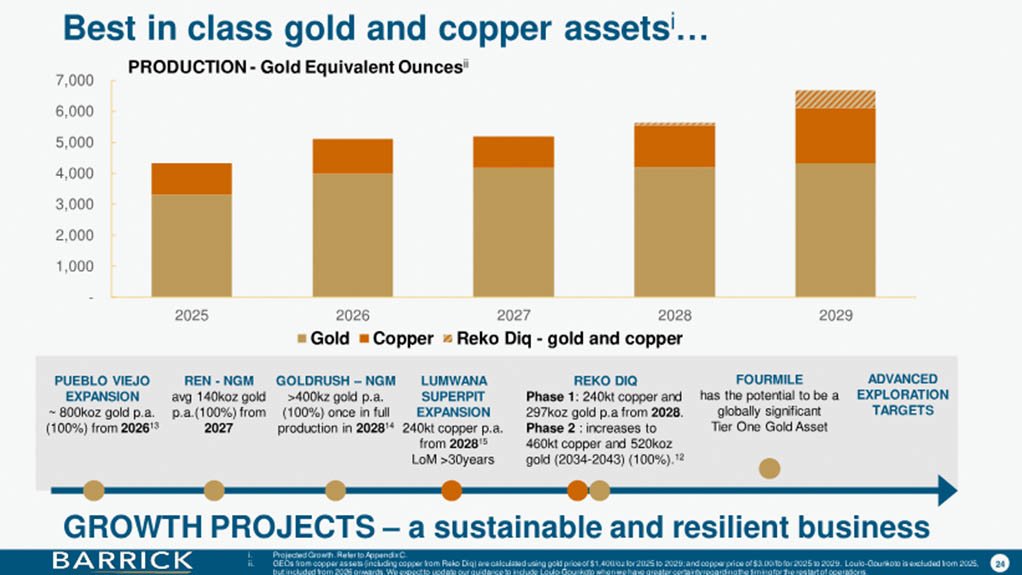

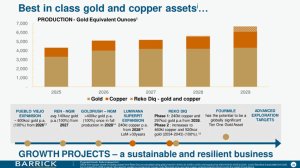

The New York- and Toronto-listed company displayed a slide detailing its ten-year rolling business plan that provides rare production, profitability and growth visibility in what it already has in Nevada gold mines in the US, Pueblo Viejo in the Dominican Republic, Tier 1 assets in Africa, all with tangible brownfield upside.

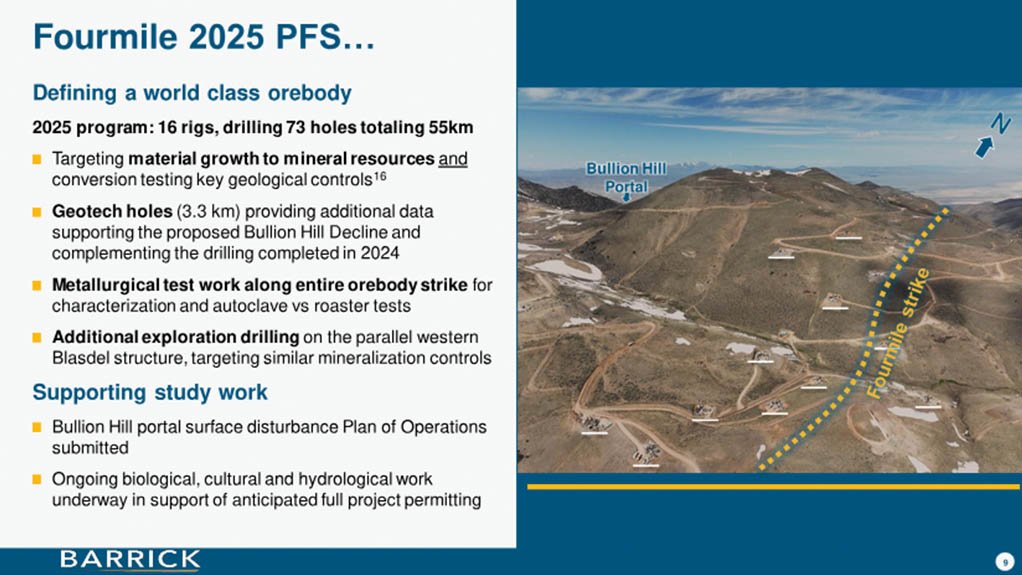

In addition, there is the Fourmile gold project, also in Nevada, the Lumwana copper expansion in Zambia, the highly promising Reko Diq growth project in Pakistan, plus the new project pipeline the exploration team is pursuing.

In the latest quarter, net earnings per share increased 59% year-on-year to $0.27 with adjusted net earnings per share growing by 84% year-on-year to $0.35.

Operating cash flow of $1.2-billion was also up 59% while free cash flow of $375-million improved materially, driving net debt reduction of 5% over the quarter.

The board again approved a quarterly dividend of $0.10 a share while the company repurchased $143-million of its shares, consistent with its commitment to shareholder returns.

Gold production of 758 000 oz was at the top end of guidance with copper production increasing to 44 000 t on improved costs.

The average realised gold price for the quarter was a 40%-higher $2 898/oz, supported stronger margins despite ongoing expansion work at Pueblo Viejo and planned maintenance at Nevada.

Full-year guidance for both gold and copper remains unchanged and growth advances were good.

At Reko Diq and Lumwana, teams have been mobilised and long-lead items secured to organically grow gold equivalent ounces by 30% by the end of the decade.

Tailings expansion at Pueblo Viejo is also on the go and 16 rigs are now active at Fourmile.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here