JOHANNESBURG (miningweekly.com) – Gold and copper mining company Barrick has signed a memorandum of understanding (MoU) with a resources organisation of the government of Zambia, which is aimed at boosting exploration and mining in the well-endowed Central African country.

The collaboration aligns with Zambia's vision of increasing its copper production to three-million tons a year in the coming decades, South African-born Barrick CEO Dr Mark Bristow revealed on Wednesday, when the New York- and Toronto-listed Barrick he leads delivered another outstanding set of financial results, notwithstanding the issues it is having to deal with in Mali, where gold sales were down significantly owing to the restrictions placed on exports by the Malian government. (Also watch attached Creamer Media video.)

The MoU has been signed with Industrial Resources Limited or IRL, a subsidiary of the Zambian government’s Industrial Development Corporation.

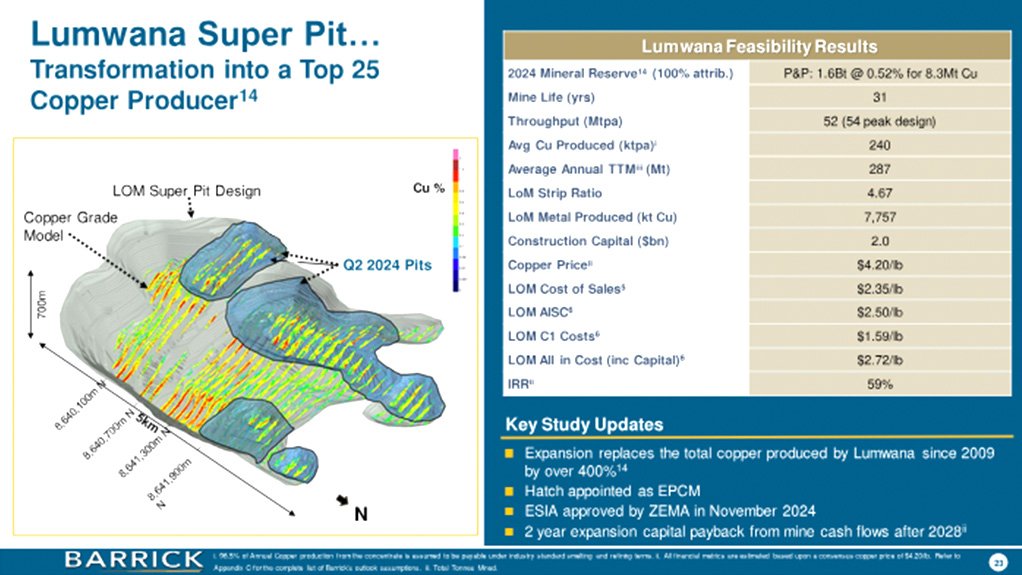

The purpose is to establish a strategic partnership capable of unlocking maximum mineral potential amid Barrick’s own Lumwana Super Pit copper expansion project in Zambia having advanced to full permitting status.

When Barrick acquired Lumwana copper mine in 2011, it was unprofitable, which resulted in a $5-billion writedown in the past five years. But a focus on cost discipline and exploration has added significantly to its reserves and has extended the life-of-mine by more than 20 years.

“Today, the mine is sustainably profitable and a pillar of our copper growth strategy,” Bristow remarked during the presentation of fourth-quarter results covered by Mining Weekly.

In the three months to December 31, Lumwana reported a stellar set of record quarterly production results that brought the mine back into guidance with considerable cost improvement.

“With the Super Pit expansion feasibility study completed, we're now moving forward with project development following board approval. The feasibility study clearly supports the value of this investment.

"Importantly, Barrick is able to fund the Super Pit expansion through its current and forecast cash flow facilities without needing to issue any new shares or take on additional debt.

“We've appointed our engineering partners and finalised the environmental and social impact studies for which we now have received the permit. We’re also on track with early works design and long lead item fabrication.

“This highlights the big advantage of emerging markets, where large expansions and new projects can be completed much more quickly than in the developed world, but at exactly the same standard,” Bristow noted.

MALI RESTRICTIONS

In spite of the challenges Barrick is experiencing in Mali, production of its Loulo Gounkoto mine increased by 8% in the fourth quarter, and exceeded guidance for the year.

In addition to export restrictions, Barrack has faced the unjust incarceration of some of its team members, which Bristow described as a difficult situation to navigate.

"We're actively engaged with the administration to secure their release and on a sustainable solution moving forward so that we can restart the mine," he said.

This situation has led Barrick to file for arbitration to assert its rights. But at the same time, it remains engaged and is hoping to continue to make progress, albeit slowly.

"Our goal remains to reach a lasting solution that brings benefits to Mali while ensuring fairness and supporting the long-term viability of this world class operation. This being crucial to the country's economy as well as all its other stakeholders.

"I thought it would be worth putting a few points into perspective, as at times, there has been a lot of misinformation about the benefits that Mali has received from the development of these assets," Bristow added.

Since 2005, Barrick has contributed more than $3.2-billion to the Malian Treasury in the form of dividends, royalties and taxes.

"More recently, in the past two years alone, we contributed $400-million in 2023 in cash to the Malian Treasury, and $460-million in 2024 to that same treasury.

"Had the mine not been forced into temporary suspension, we were on track to contribute more than $550-million in 2025 at current gold prices.

"Beyond the financial contributions, our focus has always been on long-term growth to sustain those benefits for Mali and its people."

Since 2005, Barrack has produced nearly 10.5-million ounces of gold in Mali, and has added more than 15-million ounces to reserves, extending the mine life to 2041.

"But, more importantly, we have built and developed local talent. Today, Malians are operating across our global business and their expertise is a key reason why these assets continue to succeed.

"The talent extends beyond our workforce. We have helped develop Malian businesses that have pioneered growth in the mining sector, some of which have expanded beyond Mali as a country.

"From specialised mining contractors to fuel and consumable suppliers, the economic multiplier effect of mining is immense, creating opportunities to go far beyond the mine itself," Bristow revealed.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here