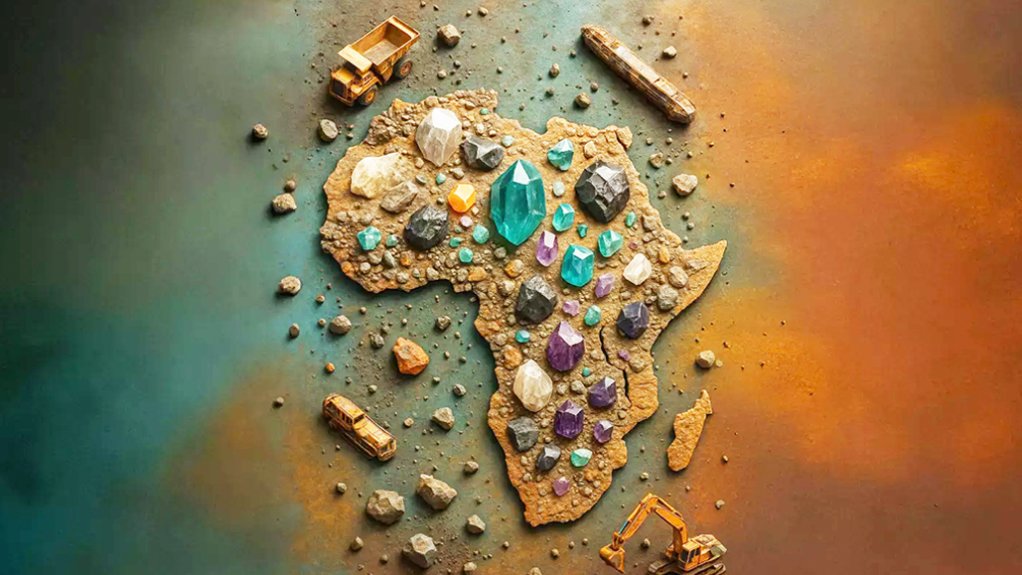

JOHANNESBURG (miningweekly.com) – African nations can leverage their critical mineral endowments to move beyond traditional extraction models and capture significantly greater value across the entire mining-to-manufacturing value chain.

In its latest Africa Series report, Boston Consulting Group (BCG) Africa identifies Africa as home to some of the world's largest production hubs for cobalt, copper, platinum group metals, and manganese, alongside vast undeveloped reserves of lithium and rare earth elements and declares that Africa is positioned to become a central player in the global critical minerals value chain as worldwide demand is expected to more than double by 2040.

Entitled 'Africa's Critical Minerals Moment: A Strategic Blueprint for Sovereign, Sustainable, and Scalable Growth', the series quotes Tycho Moencks, managing director and partner at BCG Johannesburg as stating that Africa is no longer on the sidelines of the global minerals race but that it is increasingly positioned at the centre.

"With the world's energy transition accelerating and nations scrambling to secure resilient supply chains, Africa has what the world needs. More importantly, for the first time in generations, the continent has the leverage to shape – not just serve – the next global industrial era," says Moencks in a media release to Mining Weekly.

Critical minerals – defined as materials strategically essential to modern energy systems and digital technologies, while subject to growing supply-demand imbalances, including high levels of geographical concentration in a few countries – are becoming the foundation of twenty-first-century economic power. These materials enable everything from electric vehicles and solar panels to smartphones and data centres, making secure access a matter of national strategic importance.

The economic opportunity is substantial, with BCG's analysis revealing that every $1-billion invested in mining and processing activities can create 3 000 to 6 000 direct, indirect, and induced jobs while contributing $210-million to $280-million a year to GDP in steady state. Additionally, such investments generate $70-million to $100-million in annual incremental government revenue and drive $100-million in regional infrastructure development.

"The transformation potential extends far beyond traditional mining economics," explains Lindokuhle Shongwe, project leader at BCG.

"We're talking about a fundamental shift from resource extraction to industrial transformation – one that can create high-quality jobs, build technological capabilities, and position African nations as essential partners in global clean energy and digital infrastructure development."

Given its mineral diversity and existing industrial infrastructure, South Africa emerges as particularly well-positioned to capitalise on this transformation. As the continent's leader in critical mineral endowments, its strategic advantage extends beyond extraction to encompass significant processing capabilities and established mining expertise. The country's world-leading position in platinum group metals, combined with substantial reserves of manganese, chromium, and vanadium, positions it as a potential anchor for regional value chains and a natural hub for attracting downstream manufacturing investments in battery technologies, renewable-energy components, and advanced materials processing.

To capitalise on these, the report outlines three strategic levers for unlocking Africa's full value chain advantage.

First, attracting investment through credibility and consistency requires streamlined regulations, accelerated permitting processes, and embedded environmental, social, and governance (ESG) standards. Namibia exemplifies this approach through policy reforms and ESG commitments that have attracted significant international partnerships.

Second, building regional value chains through intra-African collaboration enables distributed industrial ecosystems where countries specialise across extraction, processing, and manufacturing to maximise shared value. The Democratic Republic of Congo and Zambia are pioneering this approach through their Battery Minerals Corridor initiative, co-developing infrastructure and aligning policies to link cobalt and copper extraction to regional processing capabilities.

Third, forging global alliances and catalysing ecosystem development allows African nations to secure long-term demand while accessing concessional financing, technology transfer, and technical expertise. Morocco has successfully positioned itself as a global hub for phosphate-based battery materials through strategic partnerships spanning the EU and China.

ADVANTAGEOUS TIMING

The timing is described as being particularly advantageous for Africa. Unlike regions constrained by legacy infrastructure, African nations can leapfrog by building modern, transparent, and digitally enabled value chains from the ground up. Rwanda's pioneering digital traceability systems for tantalum exports demonstrates early momentum in this direction.

Current mining activity remains concentrated in the Southern African Development Community (SADC) region, while processing capabilities are comparatively limited across the continent. However, this presents an opportunity rather than a constraint, as countries can design new industrial capacity with sustainability and traceability built in from the start.

"Africa's mineral endowments are not just a competitive advantage – they represent a strategic one," adds Moencks. "The choices made in this critical decade will determine whether the continent remains a supplier of raw inputs or becomes a strategic actor defining the terms of its engagement with the global economy."

The report emphasises, though, that success requires moving beyond fragmented national efforts toward coordinated continental action. Established regional blocs such as SADC, the Economic Community of West African States, and the East African Community offer immediate platforms for aligning policies, sharing infrastructure investments, and coordinating development strategies.

With the African Continental Free Trade Area providing a framework for regional integration and major infrastructure projects such as the Lobito Corridor connecting fragmented markets, the foundation for transformation is already taking shape.

The global context reinforces the urgency of action. As the US, EU, and other major economies implement policies to secure critical mineral supply chains and reduce strategic dependencies, Africa's window of maximum leverage is open now.

CALL TO ACTION

Moencks concludes with a call to action, "This is Africa's critical decade – a generational opportunity that demands both ambition and execution. The continent has the minerals, the momentum, and for the first time in generations, the leverage. But windows of strategic opportunity don't remain open indefinitely. African leaders must act decisively and collectively, advancing regional coordination as the foundation for continental leadership while building institutions that enable investment rather than simply oversee it. The time to transform potential into tangible economic benefit is now."

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here