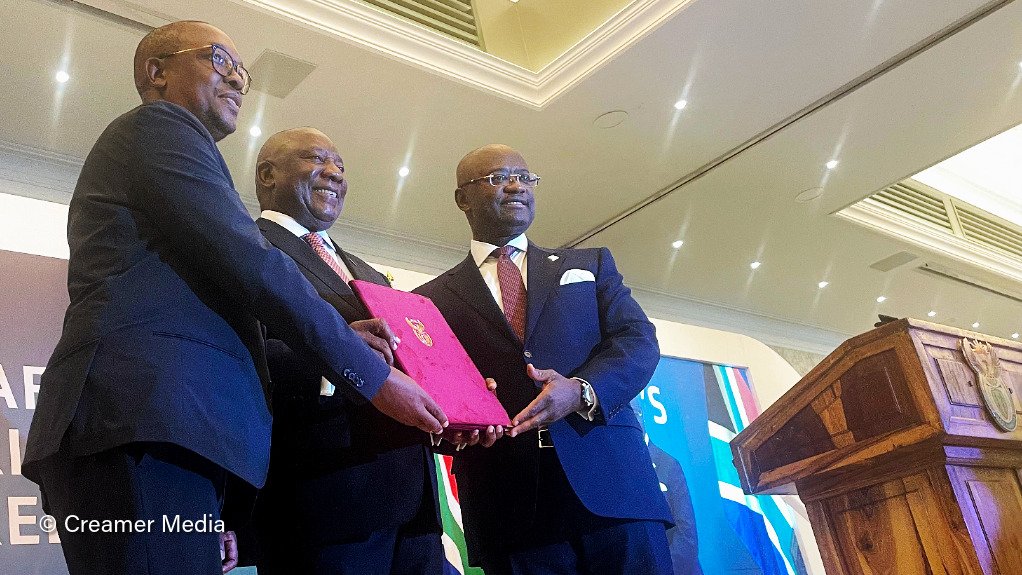

President Cyril Ramaphosa has overseen the signing of South Africa’s accession to the African Export-Import Bank (Afreximbank) establishment agreement after Parliament approved the move in November last year.

As a consequence of the signing, which was executed by Trade, Industry and Competition Minister Parks Tau and witnessed by Ramaphosa on February 4, in Johannesburg, Afreximbank president George Elombi announced that the bank had put together an initial $8-billion funding package for South Africa, geared at supporting the country’s National Development Plan (NDP) and National Industrial Policy Framework.

“This country package . . . will target key areas. We intend to invest . . . in the local processing of natural resources, thereby helping retain value within our economies, create jobs, generate wealth for our people. We intend to overwhelm the private sector, especially the processing sector, with the resources that are required.

“We intend to expand the revenue base for the South African fiscal authorities. In particular, we will prioritise mineral processing, the expansion of automotive manufacturing and development and the expansion of industrial parks and specialised zones. We plan to invest in the development of critical infrastructure, and this should include what we consider extremely important for South Africa and for many countries on our continent, that [being] energy generation and transmission,” Elombi explained.

Afreximbank exists to finance and promote trade within Africa and between Africa and the rest of the world. It backs deals, export financing, infrastructure projects, trade corridors and cross-border investment.

Prior to signing the agreement, South Africa was involved only indirectly through entities such as the Export Credit Insurance Corporation (ECIC). After signing, South Africa now becomes a full sovereign shareholder with direct voting rights and influence over the bank’s strategy.

“Today we mark a major, major milestone in our quest to realise what I would call the economic integration of our continent – Africa. South Africa's accession to Afreximbank affirms our commitment to African industrial development and to deepening trade, investment and development across our continent,” Ramaphosa said at the signing.

“The decision to accede to Afreximbank represents a strategic alignment [as] we seek to contribute to an Africa that prioritises intracontinental trade, that builds its own industrial base and capacity, and also mobilises African financial institutions to support development,” he added.

South Africa’s accession to Afreximbank means that, going forward, the country will have more say in the decisions that guide how the bank operates and where it directs money.

This will translate into better access to financing for South African companies, banks, and State-owned firms looking to export or invest in Africa.

It also means that South Africa will gain access to improved trade and investment support under the African Continental Free Trade Area (AfCFTA), with more funding and risk tools for regional trade deals and big projects.

Elombi noted that Afreximbank had planned in advance of the signing working proactively with South Africa's Department of Trade, Industry and Competition and the National Transformation Fund to design an additional $3-billion inclusive plan for South Africa to support the more marginalised and vulnerable segments of the South African economy.

“We thank Afreximbank for giving muscle to the [transformation] objective that we have. And this today, for me, means that the Transformation Fund, which others have been opposing, is going to happen and is going to happen right now. I am often amazed at those who have been privileged in the apartheid system who are trying to block us as black people as we seek to accede to becoming real economic actors in the economy of our country,” Ramaphosa averred.

Elombi further pointed out that Afreximbank had previously contributed to the participation of South African banks in the $24-billion Mozambique Area 1 liquefied natural gas project through a risk-sharing scheme with the ECIC.

The bank also provided the base financing for the preparation of a bankable feasibility study for the $500-million Nyanza Light Metals titanium dioxide pigment manufacturing project at the Richards Bay Industrial Development Zone in KwaZulu-Natal.

Elombi announced that the Afreximbank board had now fully approved its own contribution of $175-million to help fund the development phase of the project.

“South Africa's accession strengthens the bank's African mandate and opens new opportunities for the country to leverage African banks, financing, instruments, expertise and partnerships in support of national development priorities that are set by South Africa,” AfCFTA secretary-general Wamkele Mene said at the signing.

He noted that South Africa’s membership of Afreximbank would expand the country’s access to trade and project finance needed for structural economic transformation and macroeconomic stability.

“It supports investment in value added industries, export-oriented manufacturing, infrastructure and energy, whilst at the same time enabling South African companies to participate in regional value chains and benefit fully from the opportunities created by the AfCFTA,” Mene said.

He said that the signing came at a time of heightened geo-economic tensions, trade fragmentation and the increasing weaponisation of trade, investment and industrial policies.

“These trends have weakened the multilateral trading system and have increased uncertainty for our continent. We must build the domestic market. Given the current adverse global conditions, it is patently obvious that Africa must rely on herself for financing her own investment and industrial development,” Mene added.

With South Africa upgrading its Afreximbank membership, it turns it into a major shareholder in the pan-African development bank. This gives the South African government leverage and potential financial tools to push exports, support local businesses expanding across Africa, and shape trade and development finance on the continent.

“Part of the ambition is to either restructure the ECIC and/or establish a local export-import bank or national credit agency that would be able to support businesses, either with the ECIC or complementing the ECIC,” Tau said.

He added that his department had started the process of discussing what the programme would look like in detail and what the impact of the associated projects would be.

“The idea is not simply just to submit a list of projects for funding, but the idea is to have a programme [that is] linked to the NDP, our intent and our ambition as a country, both on the continent and internationally, as we diversify our markets and identify partners with whom we work. Over the next few weeks, we will be finalising the details of what that programme looks like,” Tau said.

RISKS AMID OPPORTUNITY

While State officials stressed the strategic upside of South Africa acceding to Afreximbank’s establishment agreement, the move also carried several material risks.

As a Class A shareholder, South Africa commits both paid-in capital and callable capital to the bank. Paid-in capital represents real fiscal outlay over time, while callable capital sits as a contingent liability that can be triggered if the bank faces financial stress. These obligations may not appear as headline public debt, but they still expose the fiscus to future demands.

There is also indirect risk through State-owned enterprises (SOEs) and public agencies. Afreximbank is an active lender to governments and SOEs across the continent, often in high-risk environments. If South African entities draw on these facilities and later fail to service them, political and financial pressure is likely to shift back to the State. Given South Africa’s checkered financial record with SOEs such as Eskom, Transnet and others, the assumption that such exposure will remain contained is far from guaranteed.

Accession further implies a degree of policy constraint. Membership binds South Africa to the bank’s governance structures, dispute mechanisms, and strategic direction. While this offers influence, it also limits room to manoeuvre if Afreximbank decisions conflict with domestic priorities or fiscal caution. This means that the National Treasury and other authorities would be operating within a multilateral framework rather than exercising unilateral control.

There is also reputational and political exposure. Afreximbank routinely finances projects in jurisdictions with weak governance and persistent corruption risks. This means that, when those projects unravel, major shareholders might get drawn into the fallout, regardless of their direct involvement.

For a government already facing numerous credibility challenges, accession brings several key benefits but also increases the surface area for criticism and accountability without necessarily guaranteeing commensurate returns.

“This partnership will strengthen . . . South Africa's ability to support South African exporters – that is industrial projects and regional value chains – while advancing our continent’s development. South Africa accedes to Afreximbank at a time of challenge, which at times makes people terrified, but it is also a time of great opportunity for our continent and indeed for our country as well.”

“Global economic uncertainties, climate risks and shifting trade patterns underscore the need for building economic resilience and capability as a country. We are implementing far-reaching reforms and transformative actions to restore growth, to improve competitiveness, but also to expand inclusion,” Ramaphosa said.

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY FEEDBACK

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here