The content on this page is not written by Polity.org.za, but is supplied by third parties. This content does not constitute news reporting by Polity.org.za.

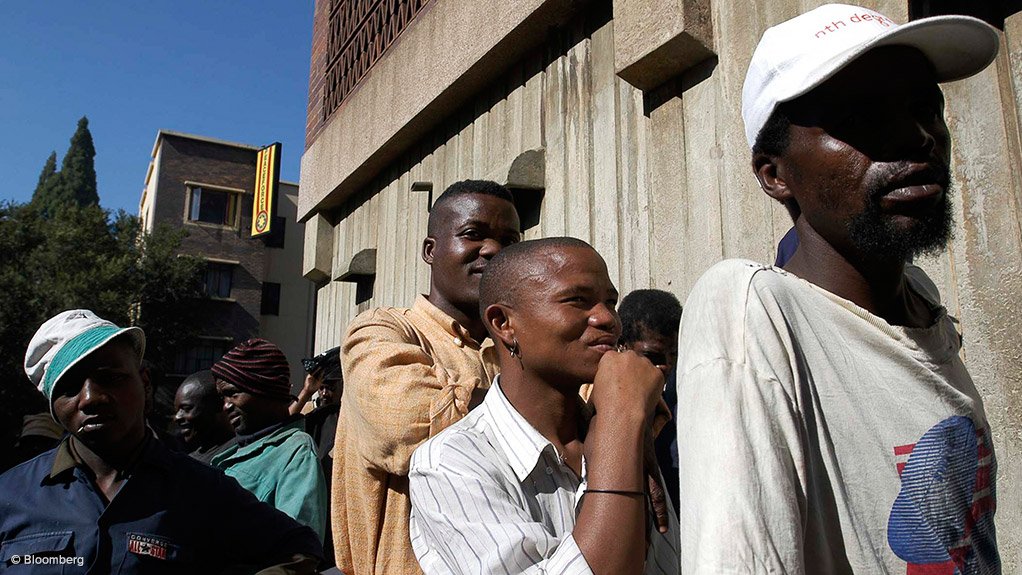

As we head into the tabling of Budget 3.0, South Africa’s unemployment crisis is spiralling out of control, and the so-called Government of National Unity (GNU) seems unable to address this crisis.

StatsSA confirmed last week what every South African can already feel that the economy is broken. The expanded unemployment rate has surged to 43.1%, the highest in almost three years, while 8.23 million South Africans are now jobless. These are not just statistics, they are stories of hardship, hunger, and hopelessness. Behind every number is a young graduate sending out CVs with no response, a breadwinner sitting at home with no income, and families forced to choose between electricity and food.

This worsening crisis is being fuelled by the GNU’s lack of urgency, policy indecision, and total absence of accountability. Despite bold promises to usher in a new era, almost one year later, nothing has changed. Economic growth remains stuck below 1%, interest payments now consume 22 cents of every Rand in tax revenue, and not a single GNU Minister has signed a performance agreement.

As the constructive opposition, ActionSA calls on the Finance Minister to present a Budget that serves all South Africans. Budget 3.0 must protect hard-pressed South Africans from higher taxes, ensure SARS is properly funded, address the rampant corruption in government departments and SOEs, and lay the foundations for meaningful economic growth.

No Bracket Creep

Since the first aborted attempt at this year’s Budget, ActionSA has called for no new taxes on individuals. With the Finance Minister committing to no VAT increase this year, we now demand urgent inflationary adjustments to personal income tax brackets, rebates, and medical credits. South Africans are fed up with paying more while the government wastes their hard-earned money through corruption, mismanagement, and waste. Budget 2.0 already expected just 7.5 million taxpayers to shoulder an additional R19.5 billion in taxes next year – an unjust and unsustainable burden.

ActionSA calls on all political parties, especially those in the GNU, to fight income tax bracket creep with the same fervour as they did to support the scrapping of the VAT increase.

SARS Properly Funded

ActionSA has consistently argued that SARS, if properly funded, is capable of collecting significantly more revenue and curb illicit trade. We are confident that SARS can, if funded properly over the medium term, collect almost R150 billion more and modernise its systems. It was ActionSA who strategically placed the issue of adequate SARS funding on the national agenda. This push for proper SARS funding was vindicated last month when SARS announced an R8.8 billion tax revenue surplus for 2024/25.

We call on the Finance Minister to increase the additional funding of R7.5 billion promised over the medium term to ensure that SARS can collect more revenue and combat illicit trade.

Greater Anti-corruption Funding

Budget 3.0 must prioritise strengthening the National Prosecuting Authority (NPA), as effective prosecution is vital to restoring public trust and deterring future corruption. This requires greater funding for the NPA’s Investigating Directorate to recruit specialists capable of handling complex corruption cases.

Since the State Capture era, the NPA has been deliberately underfunded, allowing corruption to thrive within government departments and SOEs. This corruption strangles economic growth and robs South Africans of the dignity of receiving basic services. Unless corrupt officials are criminally prosecuted and jailed, corruption will continue unchecked, with devastating consequences for ordinary South Africans, while the political elite and criminal syndicates continue to profit.

A Foundation for Economic Growth

Budget 3.0 must lay the foundation for sustainable economic growth. With GDP growth at just 0.8% for 2024, far below peer countries, South Africa urgently needs structural reforms to address unemployment, inequality, and poverty.

ActionSA calls for a shift in fiscal policy to accelerate growth and job creation, including liberalising key sectors like electricity, freight rail, and logistics. ActionSA also proposes replacing the current BBBEE system with one based on merit and genuine need, and will introduce the Inclusive Economic Empowerment (IEE) Act, which includes the establishment of an Opportunity Fund, to promote equality of opportunity over equality of outcome, and move away from the failed policies of BBBEE.

ActionSA will continue to put these critical demands forward and, as a constructive and rational opposition, ensure that Budget 3.0 protects South Africans from further tax hikes, restores the fiscus by closing corruption loopholes, and sets the stage for genuine economic growth.

Issued by ActionSA Member of Parliament Alan Beesley

EMAIL THIS ARTICLE SAVE THIS ARTICLE ARTICLE ENQUIRY

To subscribe email subscriptions@creamermedia.co.za or click here

To advertise email advertising@creamermedia.co.za or click here